EFFECTIVE JANUARY 1, 2024

Employee

Benefit Summary

MEDICAL, DENTAL,

VISION, DRUG, FSA,

LIFE INSURANCE,

403(b ) & 457(b ) ,

AND RETIREMENT

BENEFITS

Employee and Reree Service Center ¡ 45 W. Gude Drive, Suite 1200, Rockville, MD 20850

301-517-8100 ¡ www.montgomeryschoolsmd.org/departments/ersc

2024

Benefits Plan Highlights for 2024

¡ There are no changes to MCPS-offered medical, prescription,

dental, or vision plans for 2024.

VISION

We inspire learning by

providing the greatest

public education to each

and every student.

MISSION

Every student will have

the academic, creative

problem solving, and

social emotional skills

to be successful in

college and career.

CORE PURPOSE

Prepare all students to

thrive in their future.

CORE VALUES

Learning

Relationships

Respect

Excellence

Equity

Board of Education

Ms. Karla Silvestre

President

Mrs. Shebra L. Evans

Vice President

Ms. Lynne Harris

Ms. Grace Rivera-Oven

Mrs. Rebecca K. Smondrowski

Ms. Brenda Wolff

Ms. Julie Yang

Mr. Sami Saeed

Student Member

Montgomery County Public Schools (MCPS)

Administration

Monifa B. McKnight, Ed.D.

Superintendent of Schools

Mr. M. Brian Hull

Chief Operating Officer

Patrick K. Murphy, Ed.D.

Deputy Superintendent

Mr. Brian S. Stockton

Chief of Staff

Mrs. Stephanie P. Williams

General Counsel

Ms. Elba M. Garcia

Senior Community Advisor

Dr. Patricia E. Kapunan

School System Medical Officer

850 Hungerford Drive

Rockville, Maryland 20850

www.montgomeryschoolsmd.org

MCPS NONDISCRIMINATION STATEMENT

Montgomery County Public Schools (MCPS) prohibits illegal discrimination based on race, ethnicity, color, ancestry, national origin,

nationality, religion, immigration status, sex, gender, gender identity, gender expression, sexual orientation, family structure/

parental status, marital status, age, ability (cognitive, social/emotional, and physical), poverty and socioeconomic status,

language, or other legally or constitutionally protected attributes or affiliations. Discrimination undermines our community’s

long-standing efforts to create, foster, and promote equity, inclusion, and acceptance for all. The Board prohibits the use of

language and/or the display of images and symbols that promote hate and can be reasonably expected to cause substantial

disruption to school or district operations or activities. For more information, please review Montgomery County Board of

Education Policy ACA, Nondiscrimination, Equity, and Cultural Proficiency. This Policy affirms the Board’s belief that each and every

student matters, and in particular, that educational outcomes should never be predictable by any individual’s actual or perceived

personal characteristics. The Policy also recognizes that equity requires proactive steps to identify and redress implicit biases,

practices that have an unjustified disparate impact, and structural and institutional barriers that impede equality of educational

or employment opportunities. MCPS also provides equal access to the Boy/Girl Scouts and other designated youth groups.**

For inquiries or complaints about discrimination against

MCPS students*

For inquiries or complaints about discrimination against

MCPS staff*

Director of Student Welfare and Compliance

Office of District Operations

Student Welfare and Compliance

850 Hungerford Drive, Room 55, Rockville, MD 20850

240-740-3215

SWC@mcpsmd.org

Human Resource Compliance Officer

Office of Human Resources and Development

Department of Compliance and Investigations

45 West Gude Drive, Suite 2500, Rockville, MD 20850

240-740-2888

For student requests for accommodations under

Section 504 of the Rehabilitation Act of 1973

For staff requests for accommodations under

the Americans with Disabilities Act

Section 504 Coordinator

Office of School Support and Well-being

Office of Well-being, Learning and Achievement

850 Hungerford Drive, Room 257, Rockville, MD 20850

240-740-5630

504@mcpsmd.org

ADA Compliance Coordinator

Office of Human Resources and Development

Department of Compliance and Investigations

45 West Gude Drive, Suite 2500, Rockville, MD 20850

240-740-2888

For inquiries or complaints about sex discrimination under Title IX, including sexual harassment, against students or staff*

Title IX Coordinator

Office of District Operations

Student Welfare and Compliance

850 Hungerford Drive, Room 55, Rockville, MD 20850

240-740-3215

TitleI[email protected]

* Discrimination complaints may be filed with other agencies, such as the following: U.S. Equal Employment Opportunity Commission (EEOC),

Baltimore Field Office, GH Fallon Federal Building, 31 Hopkins Plaza, Suite 1432, Baltimore, MD 21201, 1-800-669-4000, 1-800-669-

6820 (TTY); Maryland Commission on Civil Rights (MCCR), William Donald Schaefer Tower, 6 Saint Paul Street, Suite 900, Baltimore, MD

21202, 410-767-8600, 1-800-637-6247, mccr@maryland.gov; or U.S. Department of Education, Office for Civil Rights (OCR), The Wanamaker

Building, 100 Penn Square East, Suite 515, Philadelphia, PA 19107, 1-800-421-3481, 1-800-877-8339 (TDD), OCR@ed.gov, or www2.ed.gov/

about/offices/list/ocr/complaintintro.html.

**This notification complies with the federal Elementary and Secondary Education Act, as amended.

This document is available, upon request, in languages other than English and in an alternate format under the Americans with Disabilities

Act, by contacting the MCPS Office of Communications at 240-740-2837, 1-800-735-2258 (Maryland Relay), or PIO@mcpsmd.org.

Individuals who need sign language interpretation or cued speech transliteration may contact the MCPS Office of Interpreting Services

at 240-740-1800, 301-637-2958 (VP) mcpsinterpretingservices@mcpsmd.org, or MCPSInterpretingServices@mcpsmd.org.

July 2023

2024

Montgomery County Public Schools

2024 Employee Benefit Summary for Active Employees

Montgomery County Public Schools (MCPS) provides a comprehensive benefit plan for employees,

retirees, and their eligible dependents. As an eligible MCPS employee, you have a variety of benefit

options from which to choose, including benefits to protect your health, your income, and your future.

The Employee Benefit Summary provides an overview of the benefits available to eligible active

employees, effective January 1, 2024. This summary includes information about eligibility for MCPS

benefits, a list of benefit costs, opportunities to reduce benefit costs through the Wellness Initiatives

program, and important contact information. It also includes instructions for accessing the online Benefits

Enrollment System (BES) during Open Enrollment, for new employees enrolling in benefits for the first

time and for employee experiencing a qualifying life event during the plan year.

Keep in mind that this is a summary of the MCPS benefit plan and is intended to help you understand and

properly enroll in the plan. Full benefit plan details are available on the Employee and Retiree Service

Center (ERSC) website at www.montgomeryschoolsmd.org/departments/ersc. The website includes

summary plan and evidence of coverage documents, along with links to provider websites.

ERSC staff members are available to assist you in person Monday through Friday from 8:00 a.m.–4:30

p.m., by telephone Monday–Friday from 8:00 a.m.–4:15 p.m., and via email. Our address, telephone

number, and email address are below:

Montgomery County Public Schools

Employee and Retiree Service Center

45 West Gude Drive, Suite 1200

Rockville, Maryland 20850

301-517-8100

Important Notice

You are not enrolled automatically in the MCPS employee benefit plan. New employees must enroll online within 60 days following

employment or wait for a future Employee Benefits Open Enrollment, typically held for four weeks beginning in early October, with

coverage effective January 1 of the following year. To enroll online, new employees must log in to the Benefits Enrollment System

(BES) by visiting the Employee Self Service (ESS) web page at:

www.montgomeryschoolsmd.org/departments/ersc/employees/employee-self-service/

From there, click the Benefits enrollment for new employees link, log in with your Outlook username and password, and follow

the onscreen instructions.

During Open Enrollment, employees visit the ESS web page and click the Open Enrollment link to log in to the BES and make

changes to their benefits. Outside of Open Enrollment, employees who experience a qualifying life event or return from long-term

leave must visit ESS and click the Benefits enrollment/changes due to a qualifying life event link to log in to BES and re-enroll in

or make changes to their benefits.

2024

Table of Contents

About Your Benefits ................................................................................................................... 1

Who is Eligible ............................................................................................................................................. 1

Eligible Dependents .............................................................................................................................. 1

Disabled Dependents ............................................................................................................................ 1

When Benefits Coverage Begins .................................................................................................................. 2

Special Rule for Newly Hired 10-Month Employees ........................................................................... 2

Special Rule for 10-Month Employees Who Terminate Employment or Retire .................................. 2

Enrolling New Dependents ........................................................................................................................... 2

Changes in or Cancellation of Coverage ....................................................................................................... 3

Loss of Non-MCPS Coverage .............................................................................................................. 4

Paying for Coverage ..................................................................................................................................... 4

When Benefits Coverage Ends ..................................................................................................................... 4

Special Rule for 10-month Employees ................................................................................................. 5

Continuation of Benefits (COBRA) .............................................................................................................. 5

Insurance Coverage While on Leave ............................................................................................................ 5

Out-of-Area Coverage .................................................................................................................................. 6

Coordination of Benefits ............................................................................................................................... 6

Birthday Rule ........................................................................................................................................ 6

Enrollment in Medicare ................................................................................................................................ 7

Enrollment Basics ....................................................................................................................... 8

Using the Online Benefits Enrollment System (BES) .................................................................................. 8

Submitting Supporting Documentation ........................................................................................................ 8

Your Benefits at a Glance .......................................................................................................... 9

Wellness Initiatives ................................................................................................................... 10

Biometric Health Screenings ...................................................................................................................... 10

Health Risk Assessments ............................................................................................................................ 10

Medical Coverage ..................................................................................................................... 10

Point-of-Service Plan .................................................................................................................................. 11

Cigna Open Access Plus .................................................................................................................... 11

Health Maintenance Organizations ..................................................................................................... 12

Cigna Open Access Plus In-Network ................................................................................................. 11

Kaiser Permanente HMO .................................................................................................................... 12

Preventive Care Services ............................................................................................................................ 12

Other Benefit Plan Coverage ................................................................................................... 18

Dental Coverage ........................................................................................................................ 18

CareFirst Preferred Dental Plan (PPO) ....................................................................................................... 18

Aetna Dental Maintenance Organization (DMO) ....................................................................................... 19

2024

Kaiser Permanente Dental Plan................................................................................................................... 19

Vision Coverage ........................................................................................................................ 21

Davis Vision Plan ....................................................................................................................................... 21

Kaiser Vision Plan ...................................................................................................................................... 22

Prescription Drug Coverage .................................................................................................... 22

CVS/Caremark Prescription Plan................................................................................................................ 22

Kaiser Permanente Prescription Plan .......................................................................................................... 26

Life Insurance ............................................................................................................................ 27

Employee Life Insurance ............................................................................................................................ 27

Basic Employee Term Life Insurance ................................................................................................. 27

Optional Employee Term Life Insurance............................................................................................ 27

Dependent Term Life Insurance ................................................................................................................. 28

Basic Dependent Term Life Insurance ............................................................................................... 28

Optional Dependent Term Life Insurance .......................................................................................... 28

Flexible Spending Accounts .................................................................................................... 28

403(b) Tax Sheltered Savings and 457(b) Deferred Compensation Plans .......................... 30

Applying for Distribution of Funds from 403(b) and/or 457(b) Accounts After Retirement ............. 31

Well Aware: Employee Wellness Program ............................................................................... 31

Retirement Benefits .................................................................................................................. 32

Social Security ............................................................................................................................................ 32

Pension Plans .............................................................................................................................................. 32

Postretirement Health Benefits ................................................................................................................... 32

Wellness Initiatives in Retirement .............................................................................................................. 32

Employee Benefit Rate Charts ................................................................................................. 33

2024

EMPLOYEE BENEFIT SUMMARY

1

About Your Benefits

WHO IS ELIGIBLE

You are eligible to enroll in the employee

benefit plan if you are a permanent MCPS

employee regularly scheduled to work 20 hours

or more per week. If your spouse has health

coverage through the MCPS employee benefit

plan and you are a covered dependent, you may

not enroll for coverage as an individual under

the MCPS employee benefit plan.

Eligible Dependents

You may choose to cover your eligible dependents

under the MCPS employee benefit plan. Eligible

covered dependents must be enrolled in the same

benefits plan in which you are enrolled.

Eligible dependents include your—

spouse, and

eligible children who meet the following age

requirements:

o until the end of the month in which they

turn 26 for medical and prescription

coverage

o until the end of the month in which they

turn 24 for dental and vision coverage

o until September 30 following their 23rd

birthday for life insurance coverage

The documentation you submit to show

eligibility of a spouse or child(ren) must include

but is not limited to the following:

Spouse:

Social Security card and

valid marriage certificate or current joint tax

return (signed by both parties or a copy of

the confirmation of electronic submission)

Newborn or Biological Children:

Social Security card and

valid birth certificate or valid birth

registration

Stepchildren:

Social Security number and

valid birth certificate or valid birth

registration and

shared or joint custody agreement (court

validated) up to age 18

Adopted Children, Foster Children, Children in

Guardianship or Custodial Relationships:

Social Security number and one of the

following:

o adoption documents (court validated)

o guardianship or custody documents

(court validated)

o foster child documents (county, state, or

court validated)

Disabled Dependents

Any disabled dependent child remains eligible

for medical and prescription coverage until the

end of the month in which he/she turns 26. A

disabled dependent remains eligible for dental,

and vision coverage until the end of the month in

which he/she turns 24. Disabled dependents

remain eligible for life insurance coverage until

September 30 following his/her 23rd birthday.

However, your disabled dependent child(ren)’s

coverage may be continued beyond these age

limits if—

he or she is permanently incapable of self-

support because of intellectual disability or

physical disability, or he/she became

disabled, and

the disability occurred before he or she

reached age 19.

It is your responsibility to notify MCPS of the

child’s incapacity and dependency to be

considered for continuous benefits coverage. If

MCPS is not notified prior to—

the dependent’s 26

th

birthday, medical and

prescription benefits will be cancelled;

the dependent’s 24

th

birthday, dental and

vision coverage will be cancelled; and

2024

EMPLOYEE BENEFIT SUMMARY

2

September 30 following the dependent’s 23

rd

birthday, life insurance will be cancelled.

Unless otherwise terminated in accordance with

the plan terms, coverage will continue as long as

the disabled child is incapacitated and

dependent. You will be asked to provide the plan

administrator with proof that the child’s

incapacity and dependency existed prior to age

19. Before the plan administrator agrees to the

extension of coverage, the plan administrator

may require that a physician chosen by your

health plan examines the child.

The plan

administrator may ask for ongoing proof that the

child continues to be disabled. If you do not

provide proof that the child’s incapacity and

dependency existed prior to age 19, as described

above, coverage for that child will end at the end

of the month in which he/she turns age 26 for

medical and prescription coverage, at the end of

the month in which he/she turns age 24 for

dental and vision coverage, and on September

30 following his/her 23

rd

birthday for life

insurance.

If you change your medical plan, you will be

required to submit new medical documentation

to the new health plan provider for review.

Coverage ends if you predecease your disabled

dependent, except as provided under federal

Consolidated Omnibus Budget Reconciliation

Act (COBRA) legislation.

WHEN BENEFITS COVERAGE

BEGINS

New employees must enroll in benefits via the

online Benefits Enrollment System (BES) within

60 days of initial employment or wait until a

future Open Enrollment to enroll online. (See

Enrollment Basics in this booklet for benefits

enrollment instructions.) Coverage begins on the

first day of the month following the month that

you enroll, provided you submit your online

enrollment by the 20th day of the month.

If you enroll online after the 20

th

day of the

month, your benefits coverage begins on the first

day of the second month. For example, let’s

assume you are hired on December 23. Refer to

the chart below to see when your coverage

would begin:

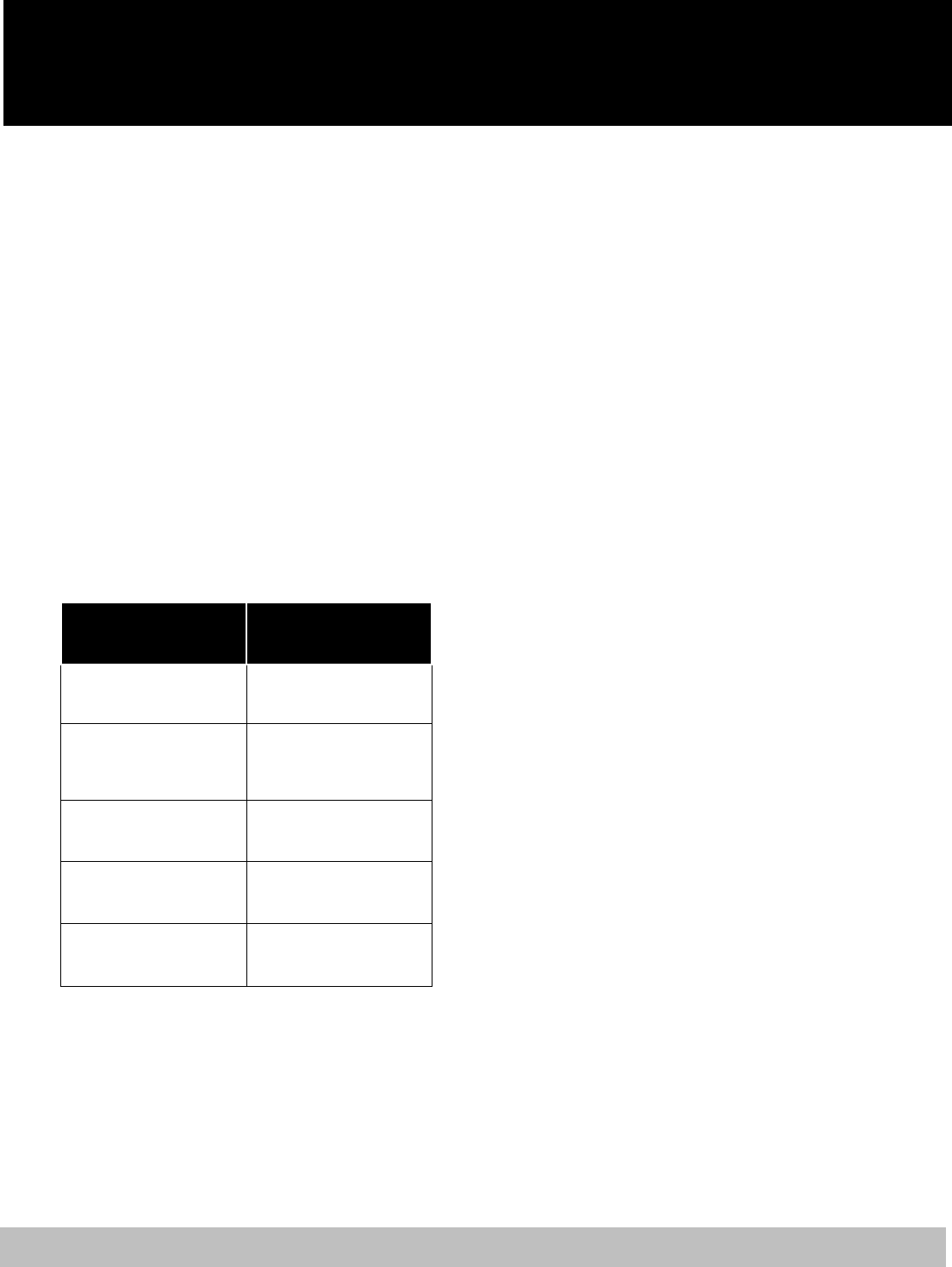

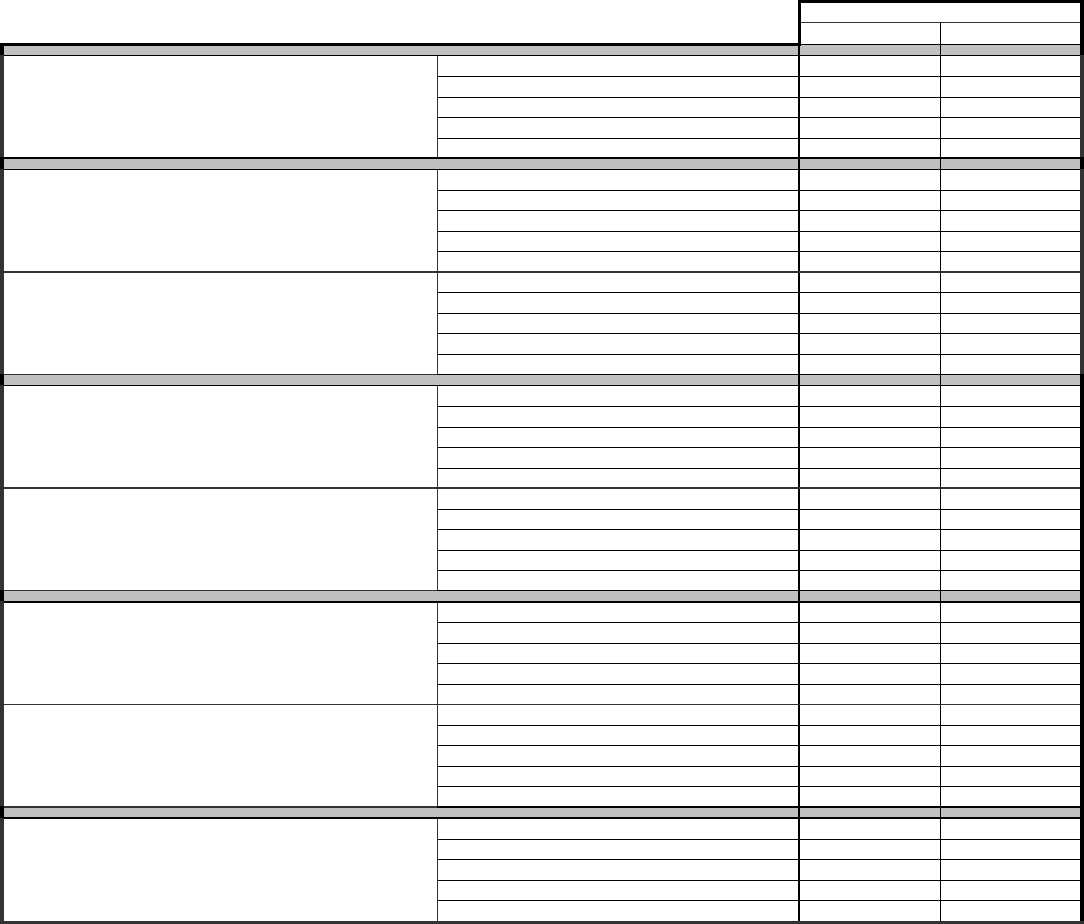

If you submit your

online enrollment:

Your coverage will

begin on:

On or before January 20

February 1

Between January 21 and

February 20

March 1

On February 21

April 1

Special Rule for Newly Hired

10-Month Employees

If you are a 10-month employee reporting at the

beginning of a school year, your coverage will

begin October 1 if you enroll by September 20.

If you enroll from September 21 to October 20,

your coverage will begin November 1. You must

enroll within 60 days of initial employment.

Special Rule for 10-Month

Employees who Terminate

Employment or Retire

A 10-month employee who terminates

employment or retires prior to their last duty day

will be issued a refund for any pre-paid health

insurance deductions (medical, dental, vision,

prescription).

A 10-month employee who terminates

employment as of their last duty day or retires

effective July 1, August 1, or September 1 will

maintain their health benefits through September

30. This is the date through which their benefits

have been prepaid.

ENROLLING NEW DEPENDENTS

Your new dependents are not covered or

enrolled automatically under the benefit plan—

you must take action to enroll new dependents in

your plan. You may enroll a new eligible

dependent in your benefit plan during Open

Enrollment or when you experience a qualifying

life event.

2024

EMPLOYEE BENEFIT SUMMARY

3

Please note that you must enroll your new

dependent through ERSC, not through the

benefit plan provider.

When you enroll a dependent in your plan,

whether as a new employee, during Open

Enrollment, or due to a qualifying life event, you

are required to use the BES. (See Enrollment

Basics in this booklet for benefits enrollment

instructions.) You will be required to provide

supporting documentation.

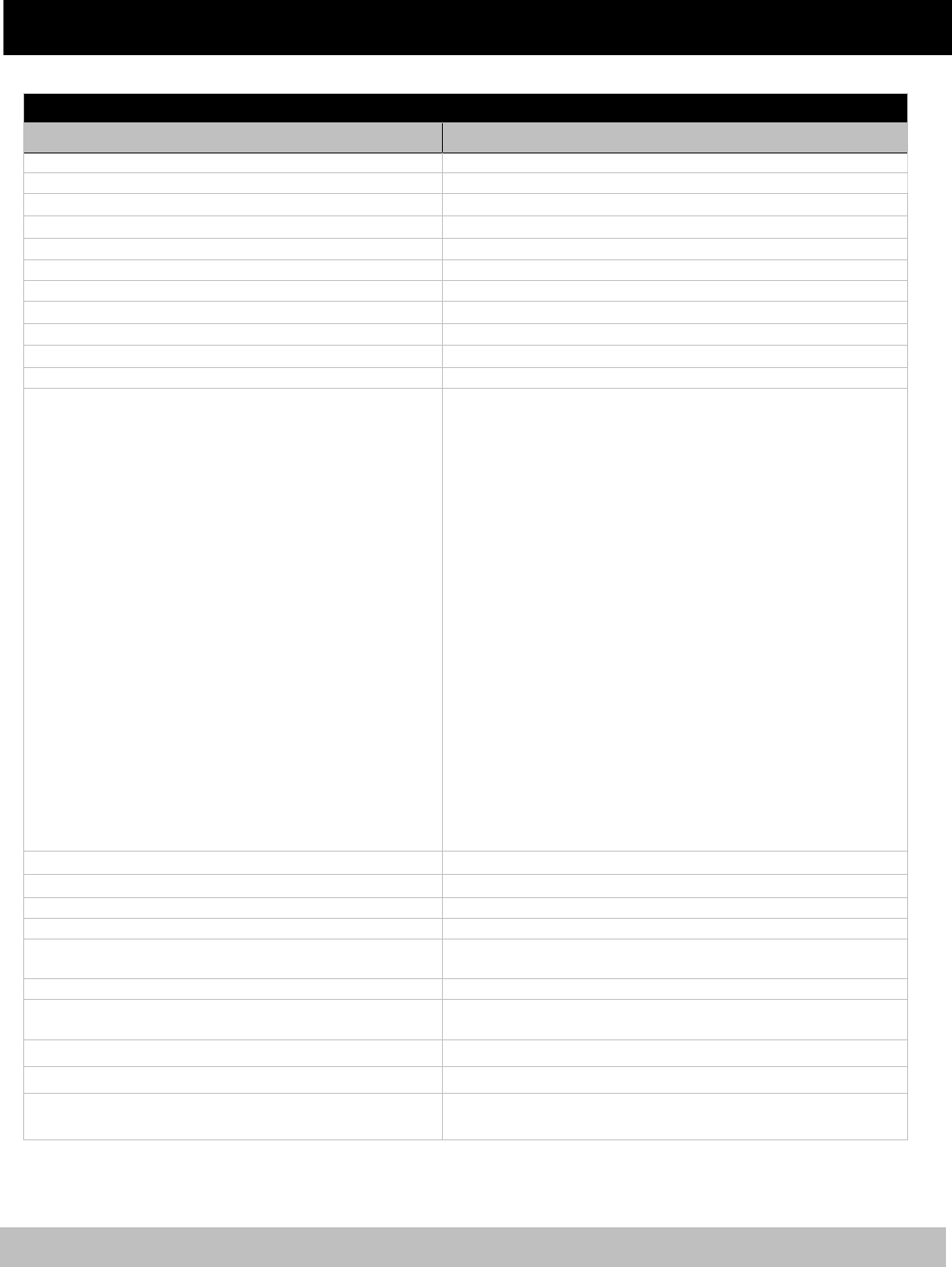

Refer to the chart below for information about

enrolling an eligible dependent if you experience

a qualifying life event. It includes important

deadlines and documentation you are required to

submit. Note: All documentation must be

translated to English prior to submitting it to

ERSC.

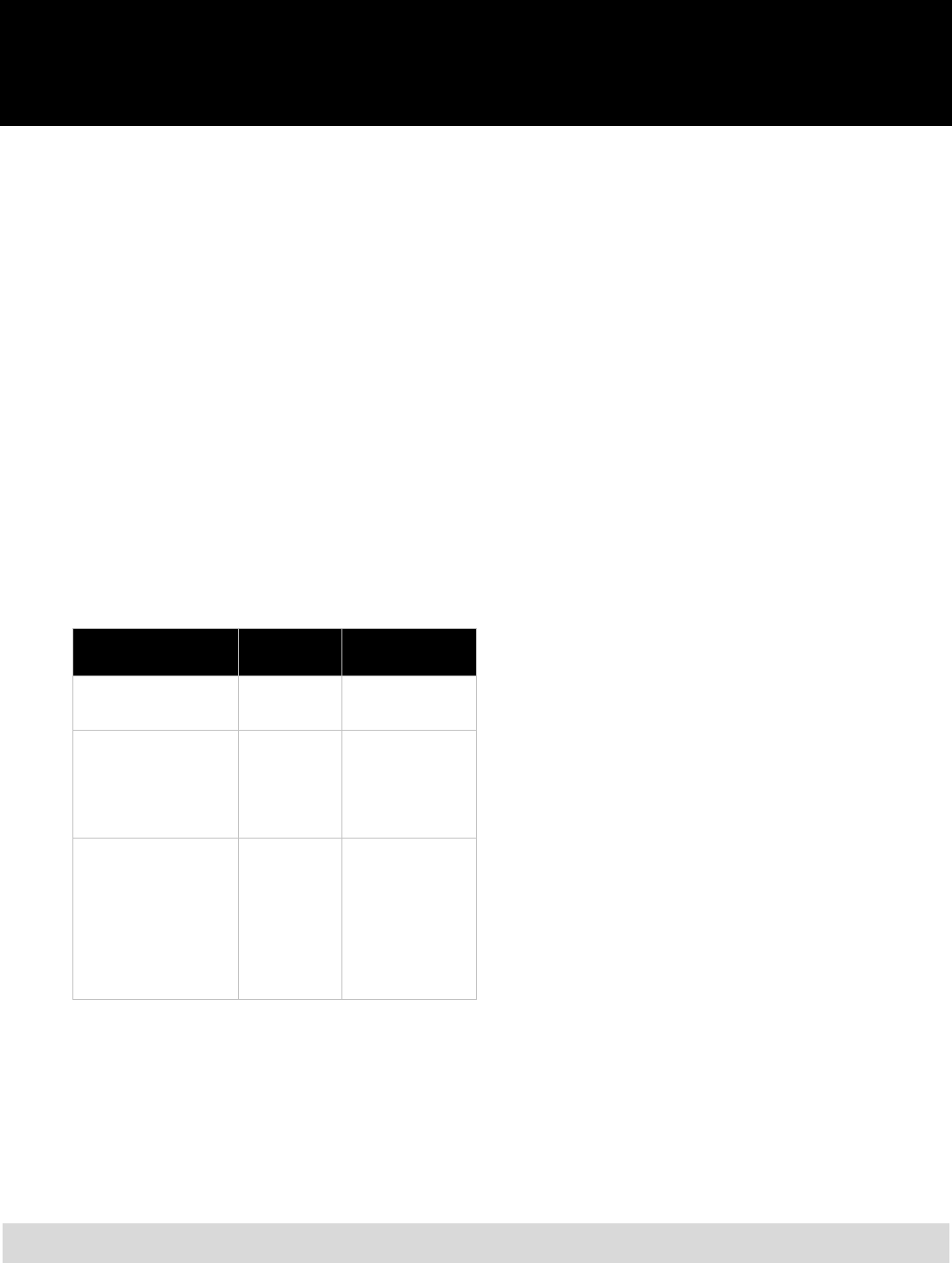

Qualifying Life Event Forms Required Deadline to Add

Newborn/adopted child

Social Security card*

Birth certificate/registration* or

Legal court documentation

60 days from the date of birth or adoption

Legal guardianship/custody

Social Security card*

Legal court documentation

60 days from the court award of legal

guardianship

Spouse

Social Security card

Marriage certificate

60 days from the date of marriage

Loss/gain of coverage

Insurance cancellation form or

COBRA notice

60 days from the date of loss/gain of

coverage

* If you cannot provide a copy of the Social Security card and a birth certificate or birth registration within

the 60-day time frame, you may enroll your newborn with evidence that you have applied for a social

security number and a birth certificate or birth registration. You must provide the social security card and

birth certificate or birth registration to ERSC upon receipt. Failure to provide this information in a timely

manner will result in termination of coverage.

Coverage for your newborn/newly adopted

dependent child(ren) will be retroactive to the

date of birth, adoption, or legal guardianship

when forms are submitted within the 60-day

time frame.

If ERSC receives all required documentation by

the 20

th

of the month, coverage for your new

dependent will begin on the first day of the

following month. If ERSC receives the forms

and necessary documents after the 20

th

of the

month, coverage for your new dependent will

start on the first day of the second month.

If you do not enroll your new dependent within

the 60-day time frame listed above, you must

wait until a future Open Enrollment to enroll

him or her using the BES.

CHANGES IN OR CANCELLATION

OF COVERAGE

In general, you are not permitted to make

changes to your benefits plan during the plan

year. You may make changes to your benefits

plan during the annual Open Enrollment held

each fall.

Certain benefit changes may be made during the

plan year if you experience a qualifying life or

work event. Qualifying life or work events

include:

Marriage/divorce

Birth of child; adoption or legal

guardianship

Death

2024

EMPLOYEE BENEFIT SUMMARY

4

Aging off plan

Change of work status (e.g., you are a .4

paraeducator, not benefits eligible, and your

hours increase to .6—you now are benefits

eligible)

Loss of non-MCPS coverage

Changes due to qualifying life or work events

may be made during the plan year, as described

in the section Enrolling New Dependents.

You may cancel your coverage at any time, but

you may

not cancel your dependent’s coverage

witho

ut proof that the dependent has coverage

elsewhere. It is recommended that you

notify

ERSC promptly because removing a

dependent could change your coverage level

and reduce your

cost. You must provide

evidence o

f other coverage in order to drop a

dependent from coverage.

Also, while you may add or drop yourself, a

spouse, or dependent(s) from your benefits plan

outside of Open Enrollment due to a qualifying

event, you may not make changes to your

benefits plan outside of Open Enrollment. This

means you may not change insurance plans or

cancel individual components of your benefit

plan during the plan year.

If you choose to

cancel coverage outside of

Open Enrollment, you must cancel the entire

employee benefit plan—with the exception of

life insurance coverage(s).

To cancel or change coverage due to a

qualifying life event outside of Open

Enrollment,

you must visit the Employee Self-

Service web page at

www.montgo

meryschoolsmd.org/departments/er

sc/employees/employee-self-service/ and click on

the Benefits enrollment/changes due to a

qualifying life event

link. You have 60 days

from the date of the qualifying event to enroll

and submit the req

uired supporting

documentation to ERSC. You must either

upload this information to the BES when you

enroll or mail it to ERSC.

If ERSC

receives all required documentation by

the 20

th

of the month, changes to or cancellation

of your coverage will become effective on the

first day of the following month. If ERSC

receives the forms after the 20

th

of the month,

changes to your coverage will become effective

on the first day of the second month.

If you do not enroll and provide the necessary

documentation within the 60-day period, you

must wait until a future Open Enrollment to

make any changes using the BES.

Remember: It is your responsibility to

promptly notify ERSC of any changes to your

personal information (e.g., name or address)

or coverage needs.

Loss of Non-MCPS Coverage

You may enroll in an MCPS-provided benefits

plan during the plan year if you or your benefits-

eligible dependents lose coverage provided by a

business or organization other than MCPS. Your

benefits coverage will be effective the first of

the month following your enrollment.

PAYING FOR COVERAGE

You pay for your health plan coverage with

premiums deducted from your paycheck on a

pretax basis. Your premiums are deducted

before income and payroll taxes are calculated,

and your deductions are taken in equal amounts.

The detailed cost is shown on your ePaystub.

Ten-month employees have deductions

taken from 20 paychecks during the school

year.

Twelve-month employees have deductions

taken from 26 paychecks.

Refer to the rate chart at the end of this

document for the base health coverage costs for

2024.

WHEN BENEFITS COVERAGE ENDS

If you terminate employment with MCPS,

benefits coverage for you and any covered

dependents ends on the last day of the month

you terminate employment.

2024

EMPLOYEE BENEFIT SUMMARY

5

Dependent life insurance coverage for a

dependent child automatically ends on

September 30 following the child’s 23

rd

birthday. For dental and vision plans, benefits

coverage for a dependent child automatically

ends at the end of the month in which he/she

turns age 24. For medical and prescription plans,

a dependent child’s coverage automatically ends

at the end of the month in which he/she turns

age 26.

Special Rule for 10-month

Employees

If you are a 10-month employee and you

terminate employment with MCPS at the end of

a school year (on your last duty day based on

your work schedule), your coverage continues

through September 30 because you have prepaid

for benefits through the summer.

CONTINUATION OF BENEFITS

(COBRA)

If your coverage ends, you and your dependents

may be eligible to continue coverage as provided

under COBRA.

You and/or your dependents may become

eligible for coverage under COBRA if you

terminate employment or you and/or your

dependents become ineligible for coverage

under the MCPS benefits plan. You may

continue coverage by paying the full cost of

coverage plus a 2 percent administrative fee for

a period legally-mandated by COBRA

regulations (generally 18–36 months).

MCPS does not share the cost of COBRA

coverage. A COBRA rate chart can be found on

the ERSC website. You will receive a qualifying

event notice (QEN) from the MCPS third party

administrator.

INSURANCE COVERAGE WHILE

ON LEAVE

If you are on an approved leave of absence, you

may elect to continue or terminate your coverage

under the MCPS employee benefit plan.

Depending

on the type and duration of your

leave of absence, you may be required to pay

either the employee share or the full cost of

coverage. For most unpaid leave categories,

there is not an MCPS subsidy, and you are

responsible for 100 percent of the cost of

insurance while on leave. More information

regarding leave of absence policies is available

on the ERSC website at

www.montgomeryschoolsmd.org/departments/er

sc/employees/leave/.

You may elect to terminate coverage by

indicating your choice on the appropriate BES

screen(s). If you wish to continue coverage

while on leave, no action is required.

You can continue life insurance coverage

without continuing medical, dental, vision, or

prescription coverage. If you elect to continue

life insurance coverage, you will be billed by the

MCPS Division of Controller. Failure to pay the

required premium will result in cancellation of

coverage.

Please be advised that if you terminate your

coverage while on leave and, after returning to

work, wish to re-enroll in benefits, you must do

so within 60 days of returning to active work

status. You must re-enroll in the same coverage

you had prior to going on leave. If you had

covered dependents prior to going on leave, the

same dependents will remain eligible for re-

enrollment. If you marry, have a child, or adopt

a child while on leave, they may be added to

your plans with the appropriate qualifying event,

within 60 days of the event. If the birth or

marriage occurred outside of the last 60 days

while on leave, you will need to wait to add the

new dependent during Open Enrollment or when

experiencing another qualifying life event.

In most cases, you cannot continue your

participation in a flexible spending account

(FSA) while on leave. Your FSAs are cancelled

as of the last deduction taken once you are on

leave, and you must reenroll within 60 days of

returning from leave. You can incur expenses up

to the date your leave begins and have until

April 30 following the plan year to submit

claims for reimbursement.

2024

EMPLOYEE BENEFIT SUMMARY

6

While on an approved leave of absence

protected by the Family and Medical Leave Act

(FMLA), you may choose to re-enroll in an

FSA. To do so, complete and submit MCPS

Form 450-3, Flexible Spending Account Election

to have your FSA contributions direct billed to

you.

If you fail to reenroll in the employee benefit

plan within 60 days of returning to active work

status, you must wait until a future Open

Enrollment. In order to reenroll for basic

employee life insurance or optional employee

and optional dependent life insurance, you and

your spouse must provide evidence of

insurability and be approved by MetLife.

If you are absent from work without approved

leave, you still are required to pay health

insurance premiums. If in any given pay period

you do not have sufficient funds to cover the

cost of your insurance premiums, the premiums

will be withheld from your next paycheck. In the

event of a longer unapproved absence from

work, you will be billed the full cost premium

rate. Please keep in mind that you could

jeopardize your eligibility to continue health

insurance coverage if you are absent without

approved leave. For additional information

about leave of absence policies, visit the ERSC

website at

www.montgomeryschoolsmd.org/departments/er

sc/employees/leave/

OUT-OF-AREA COVERAGE

If you are enrolled in the Kaiser Permanente

Health Maintenance Organization (HMO)

medical plan, any eligible dependents that reside

or attend school outside the service area of the

HMO will be covered only for urgent care or

emergency services.

You are covered anywhere in the world for

emergency and urgent care with your Kaiser

Permanente plan. If you regularly travel to

another service area where you will receive

Kaiser Permanente care, you can get a

health/medical record number and a kp.org

account to seamlessly receive care. When

travelling in an area outside of any Kaiser

Permanente service area, you can get care at a

MinuteClinic® and you will be charged your

standard copay or coinsurance. Learn more at

kp.org/travel. Refer to the HMO summary plan

document for details.

Members of the Cigna OAP (POS) plan or

OAPIN (HMO) plan have access to a national

network of doctors and medical facilities. Both

plans provide in-network benefits should you

and/or your dependents seek medical care while

travelling or living outside the service area. If

you are covered by the Cigna OAP plan, you

also have the option to see a nonparticipating

provider, but your out-of-pocket expense will be

higher if you do. If you receive services from a

provider outside of the network, you will have

to—

pay the provider’s actual charge at the time

you receive care,

file a claim for reimbursement, and

satisfy a deductible and coinsurance.

COORDINATION OF BENEFITS

If you or one of your dependents is covered by

more than one insurance plan, there is an order

of benefits determination established by the

National Association of Insurance

Commissioners. The primary plan will be the

first to consider the medical services rendered

for coverage. Any medical care not covered by

the primary plan in full will be considered for

payment by the secondary plan.

Your employee plan is your primary coverage

over any other plan that covers you as a

dependent spouse.

Birthday Rule

If dependent children are enrolled for insurance

coverage with both biological parents (one

MCPS plan, one non-MCPS plan), the primary

insurance plan for the children is determined by

the birthday of the parents.

The plan of the parent with the birthday that

comes first in the calendar year (month and day

only) is primary for the child(ren). This order of

benefits determination for dependent children is

known as the birthday rule.

2024

EMPLOYEE BENEFIT SUMMARY

7

All medical plans offered by MCPS use the

birthday rule for primary insurance plan

determination. The birthday rule does not apply

to stepchildren. Primary care for dependent

stepchildren is determined by the courts.

ENROLLMENT IN MEDICARE

As an active MCPS employee, if you and/or

your covered dependent(s) are eligible for

Medicare due to age, illness, or disability, you

may defer Medicare Part B enrollment without

penalty as long as you are covered by any active

MCPS medical plan. Deferring Medicare

enrollment will save you the cost of additional

monthly Medicare Part B premiums while

maintaining your MCPS medical coverage.

Enrollment in Medicare Part B will not provide

additional medical coverage beyond what

already is included in all MCPS medical plans.

Therefore, employees typically defer Medicare

Part B enrollment until retirement when deferral

no longer is permitted.

If you and/or your qualified dependent(s) defer

Medicare enrollment, you still will be required

to enroll in Medicare Parts A and B when you

retire and no longer are covered by the active

employee health plan. Enrollment in Medicare

must coincide with your retirement date and is

arranged by contacting the Social Security

Administration at least three months prior to

your retirement. At the time of your retirement,

you must submit a copy of the Medicare card(s)

to ERSC with your retirement papers.

Conveying this information to ERSC will

initiate the necessary process to update your

benefit enrollment and notify the insurance

carriers.

All retirees and dependents covered by any

MCPS retiree medical plan are required to enroll

in Medicare Parts A and B when first eligible to

remain covered by the MCPS plan. Once

enrolled, Medicare will be your primary

insurance, and the MCPS medical plan provides

secondary coverage as a supplement to

Medicare.

If you and/or your dependent(s) become

Medicare eligible at any time du

e to end-stage

renal disease (ESRD), you must notify ERSC at

301-517-8100.

Detailed information about post-retirement

health coverage and Medicare is provided during

the Retirement Informational Sessions offered

by ERSC and also is included in the Retiree

Ben

efit Summary, which is available online at

www.montgomeryschoolsmd.org/uploadedFiles/

retiree_benefit_summary_current.pdf.

Please Note

Application for Medicare Part B is completed through your

local Social Security office or online at:

https://www.ssa.gov/benefits/medicare/

2024

EMPLOYEE BENEFIT SUMMARY

8

Enrollment Basics

USING THE BENEFITS ENROLLMENT

SYSTEM (BES)

Employees who wish to enroll in or make

changes to their benefits either when first hired,

during an annual Employee Benefits Open

Enrollment, or when experiencing a qualifying

life event or returning from long-term leave

must make their elections using the BES. To

access and use the system, visit the Employee

Self-Service (ESS) web page at

www.montgomeryschoolsmd.org/departments/er

sc/employees/employee-self-service/.

If you are a new employee, click on the Benefits

enrollment for new employees link. Those

making changes during Open Enrollment click

on the Open Enrollment link. Those

experiencing a qualifying life event click on the

Benefits enrollment/changes due to qualifying

life event link. Then, log in using your Outlook

username and password and follow the onscreen

instructions.

The BES allows you to quickly and easily

review, update, and confirm your benefit

elections; elect a medical or dependent care

flexible spending account (FSA); and designate

your life insurance beneficiaries. Since it is

online, there are no paper forms to fill out or

send in. You simply make your elections and

submit them with a series of clicks.

SUBMITTING SUPPORTING

DOCUMENTATION

Employees adding a dependent to their benefit

plan—whether during Open Enrollment or due to

a qualifying life event—must submit the

necessary supporting documentation to ERSC.

Supporting documentation may be uploaded

during the online enrollment process via the BES

or mailed or delivered in one of the following

ways:

Email: [email protected]

Mail: 45 W. Gude Drive, Suite 1200,

Rockville, Maryland 20850

Pony mail: ERSC at 45 W. Gude Drive

Fax: 301-279-3651 or 301-279-3642

If you choose to submit supporting

documentation via the BES or email, you must

submit an electronically signed Adobe PDF file.

When submitting hard copies of supporting

documentation, please write your name and

employee identification number in the upper

right corner of each page.

2024

EMPLOYEE BENEFIT SUMMARY

9

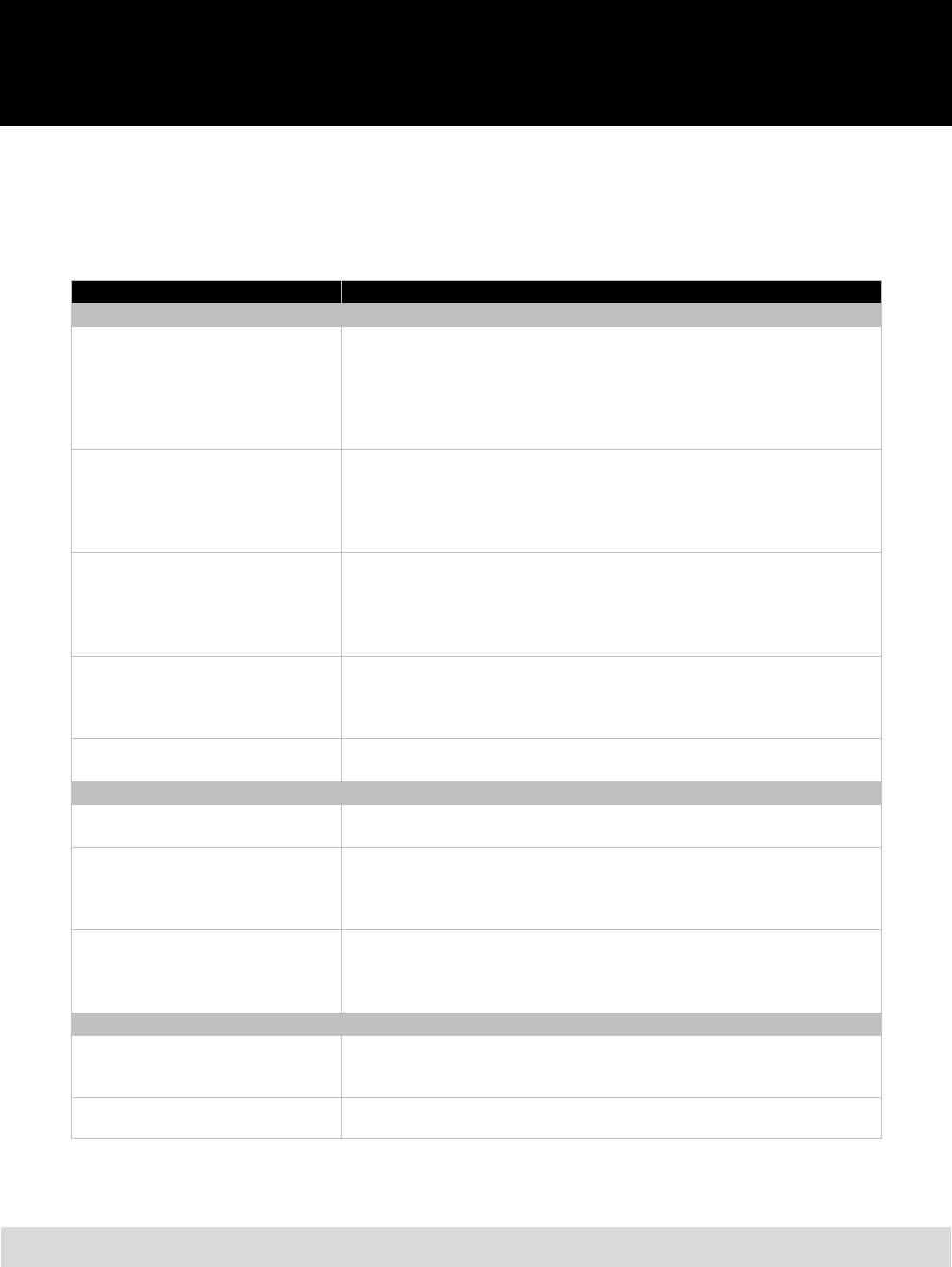

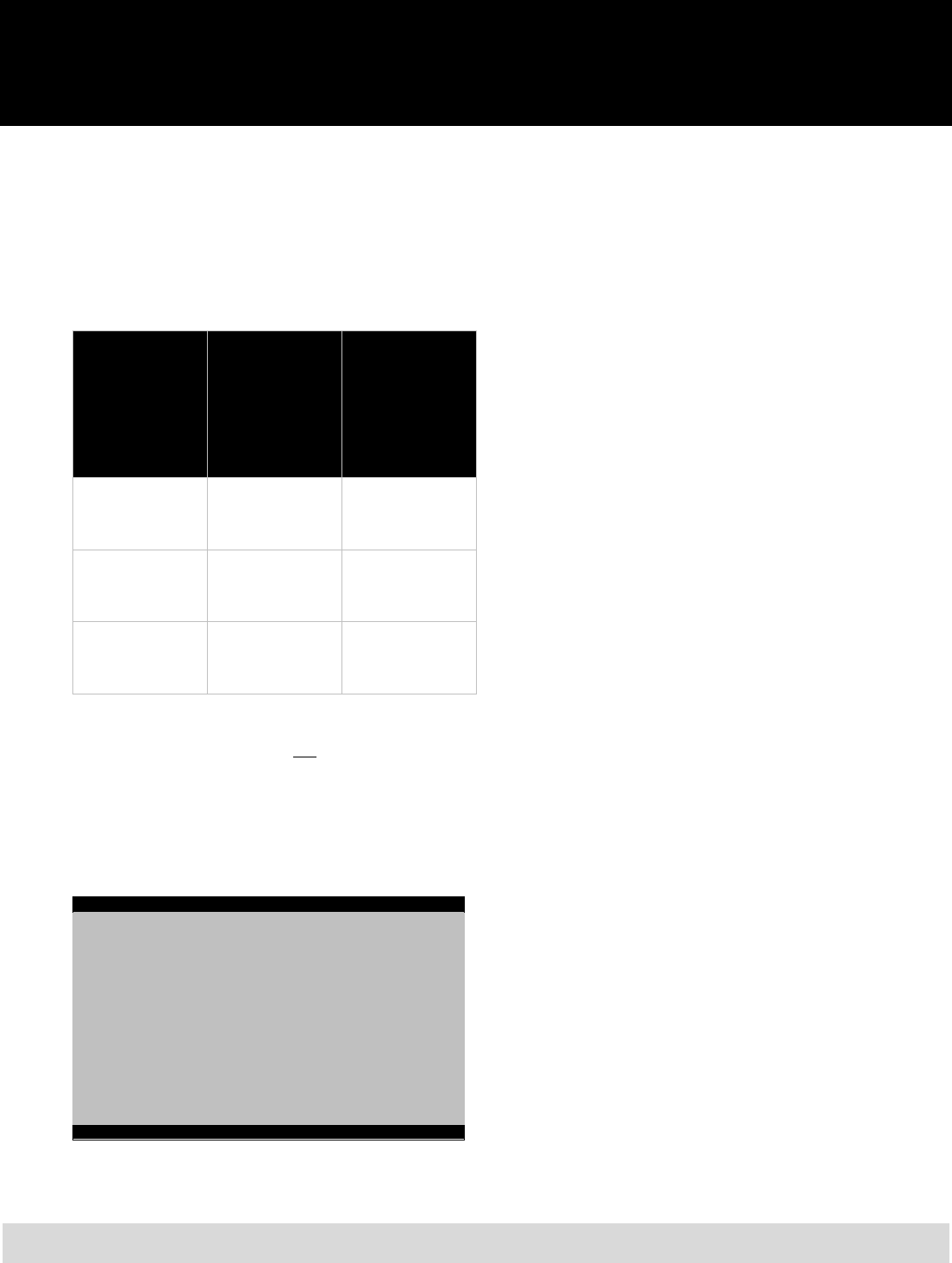

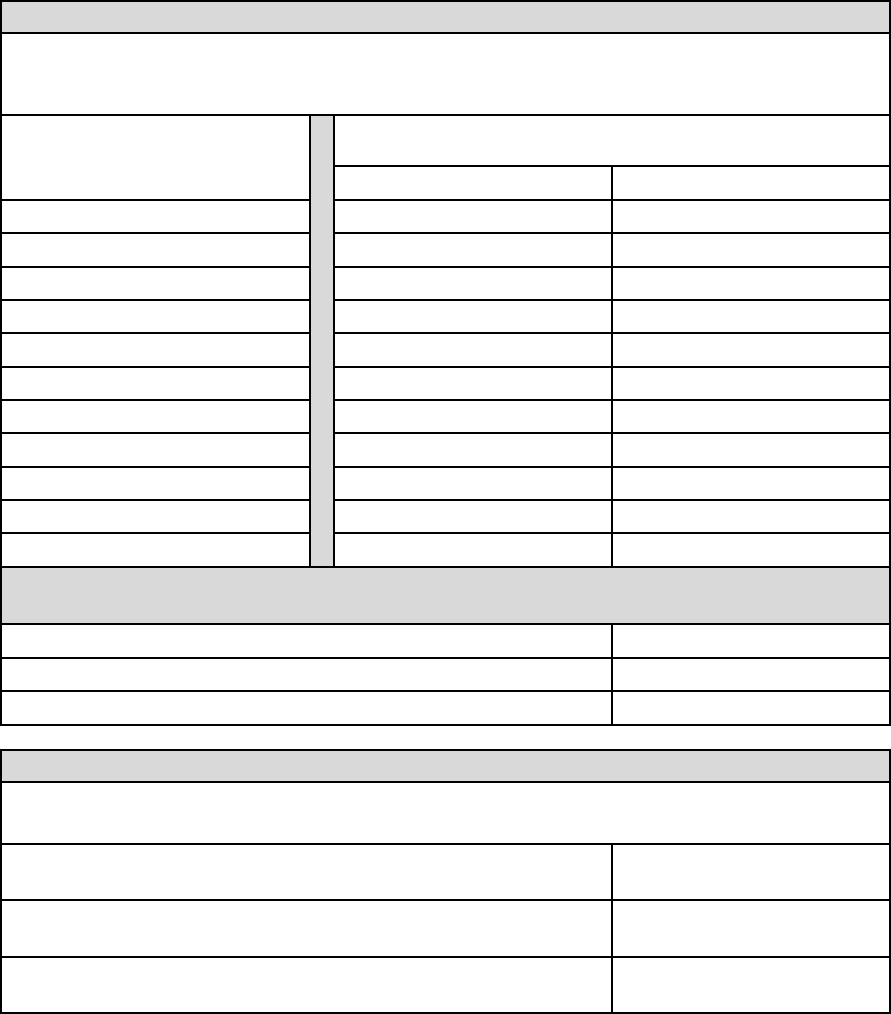

Your Benefits at a Glance

The chart below is a brief overview of your benefit options for 2024. For more information, refer to the

appropriate section in this benefits summary.

Benefit

Y

our Options

Protectin

g

Your Health

Medical

Point-of-Service (POS) Health Plans

Health Maintenance Organizations

(HMO) Health Plans

Cigna Open Access Plus (OAP)

Cigna Open Access Plus In-Network (OAPIN)

Kaiser Permanente HMO

Prescription Drug

CVS Caremark Prescription Drug

(only available to Cigna plan participants)

Kaiser Permanente Prescription Drug

(only available to Kaiser Permanente plan participants)

Dental

CareFirst Preferred Dental Plan (PPO)

Aetna Dental Maintenance Organization (DMO)

Kaiser Permanente Preventive Dental Coverage

(included in medical plan; available only to Kaiser Permanente medical plan

participants)

Vision

Davis Vision (provided through CareFirst)

Kaiser Permanente Vision Plan

(included in medical plan; available only to Kaiser Permanente medical plan

participants)

Wellness Initiatives

Health Risk Assessments

Biometric Health Screenings

Protecting Your Income

Flexible Spending Accounts

Medical spending account (up to $3,050/year)

Dependent care account (up to $5,000/year or $2,500/year if filing separately)

Basic Term Life Insurance

MetLife—

Employee (83 percent paid by MCPS)—2 times annual salary

Dependent (paid by MCPS)—$2,000/spouse, $1,000/each eligible dependent

child up to age 23

Optional Life Insurance

MetLife—

Employee—1 times annual salary (paid by employee)

Dependent—$10,000/spouse or each eligible dependent child (paid by

employee)

Protectin

g

Your Future

Defined Contribution Plans

403(b) Tax Sheltered Savings Plan

457(b) Deferred Compensation Plan

Fidelity—You can elect a percentage of your gross bi-weekly pay or a flat dollar

amount to contribute to one or both plans up to annual IRS limits (available at

www.netbenefits.com/mcps)

Defined Benefit Pension Plans

By completing the appropriate forms, you are enrolled in state and/or county-

sponsored pension plans.

2024

EMPLOYEE BENEFIT SUMMARY

10

Wellness Initiatives

To develop a culture of wellness within MCPS,

the Wellness Initiatives program was established

as part of the school system’s benefit program.

Expanding the efforts of the MCPS employee

wellness program, Well Aware, the program is

intended to educate employees about their health

while offering incentives to those who

participate. Wellness Initiatives is in accordance

with Montgomery County Education

Association (MCEA), Service Employees

International Union (SEIU) Local 500, and

Montgomery County Association of

Administrators and Principals (MCAAP)/

Montgomery County Business and Operations

Administrators (MCBOA) contracts.

Each year, if you are covered by an MCPS-

provided medical insurance plan through Cigna

or Kaiser Permanente, you can reduce your

contributions to your health insurance by

completing a biometric health screening and/or

an online health risk assessment. You must

complete them between the first day of fall

Open Enrollment and the Friday before the

next Open Enrollment begins a year later.

Once you have completed your biometric health

screening and/or health risk assessment, the

incentive(s) will go into effect January 1 of the

calendar year that follows the deadline.

BIOMETRIC HEALTH SCREENINGS

Biometric health screenings monitor for disease

and assess risk for future medical problems. By

completing a biometric health screening of your

blood pressure, blood sugar, body mass index

(BMI), and cholesterol, you will be eligible for a

1 percent increase in MCPS contributions

toward your health insurance. This means that

your contribution to your health insurance will

be reduced by 1 percent if you complete the

biometric screenings within the above time

frame. Your health screening may be completed

by your primary care physician or at one of your

medical plan’s health screenings sponsored by

Well Aware.

Note to Kaiser Permanente plan members:

You must log in

to the Kaiser Permanente website

at www.webmdhealth.com/kp/750/landing to

confirm your participation in the Wellness

Initiatives program and determine if you must

meet any additional requirements.

HEALTH RISK ASSESSMENTS

Health risk assessments are online surveys that

ask basic health

and lifestyle questions to

provide you with a baseline of your current

health status. If you complete a health risk

assessmen

t by the deadline, your contribution to

your health insurance will be reduced by 1

percent.

Your online health risk assessment must be

completed through the medical plan in which

you are enrolled. If you have not already done

so, you will need to create an online account

with

your medical plan. To set up your account,

visit your medical

plan’s website (listed below)

and complete a simple registration process:

• Cig

na—www.MyCigna.com

• Kaiser Permanente—www.kp.org

MCPS will not receive the results of your

biometric health screening or health risk

assessment. Your health insurance carrier will

only indicate whether you have completed your

screening and/or assessment. Your personal

information is protected by the federal Health

Information Portability and Accountability Act.

Medical Coverage

You may choose one of the following medical

plan options:

Point-of-Service (POS) option:

Cigna Open Access Plus (OAP)

Health Maintenance Organization (HMO)

options:

Cigna Open Acce

ss Plus In

-Network

(OAPIN)

Kaiser P

ermanente HMO

2024

EMPLOYEE BENEFIT SUMMARY

11

P

OINT-OF-SERVICE PLAN

A POS plan combines features of an HMO and

an indemnity plan. You receive care in one of

two ways. There is an in-network HMO-like

component offering a full range of services

provided or authorized by your primary care

physician or by an in-network specialist. In

addition, there is an out-of-network component

similar to traditional indemnity insurance. The

out-of-network benefit provides payment for

treatments received from non-network

physicians or specialists after the coinsurance

and a yearly deductible are met. You also will be

responsible for any amount above the usual,

customary, and reasonable (UCR) charges

determined by the plan.

The POS plans do not require you to obtain a

referral to visit a participating in-network

physician or specialist for medically necessary

care.

Cigna Open Access Plus (POS Plan)

MCPS offers this POS plan to employees and

their eligible dependents through Cigna. Cigna

Open Access Plus (OAP) is designed to provide

the highest quality healthcare while maintaining

the freedom to choose from a wide selection of

personal physicians. You have the option to

choose a PCP who specializes in one of these

areas: family practice, internal medicine, general

medicine, or pediatrics. Your PCP or personal

physician can be a source for routine care and

for guidance if you need to see a specialist or

require hospitalization. To access an online

provider directory, please visit www.cigna.com.

With this plan, you have the option to go to any

medical person and facility. However, when

choosing the providers in the OAP network,

your benefit coverage will be greater than opting

to receive services outside the network.

Cigna OAP provides well-managed services to

deliver cost-effective, quality care through the

physicians’ private offices and facilities. To

ensure full and proper medical treatment, and

reduce unnecessary procedures, this plan

emphasizes preadmission screening and prior

authorization for specific services.

As a participant in this plan, you have access to

Cigna’s national network of doctors and

facilities. The availability of a national network

allows access to in-network care for members

wherever you are in the country, when traveling,

and for dependent children when they are living

out of state.

Diabetic supplies are covered under the

prescription drug benefit administered by

CVS/Caremark. Refer to the POS comparison

chart later in this document for more details.

HEALTH MAINTENANCE

ORGANIZATIONS

A health maintenance organization (HMO) plan

offers a full range of services provided by your

PCP or by an in-network specialist. You may

receive benefits only for medical services and

supplies received from a network provider,

except in a true emergency. However, you do

not have to meet a deductible before the plan

pays benefits.

Refer to the HMO comparison chart outlined

later in this document for further details.

Cigna Open Access Plus In-Network

(HMO Plan)

The Cigna Open Access Plus In-Network

(OAPIN) option allows participants to visit any

Cigna network provider without a referral.

Cigna offers access to care from participating

physicians and facilities, with low out-of-pocket

expenses. You may have the option to choose a

PCP to coordinate your care, and pay only a

copayment for most services. You do not have to

complete a claim form.

As a participant in this plan, you have access to

Cigna’s national network of doctors and

facilities. The availability of a national network

allows access to in-network care for members

wherever you are in the country, when traveling,

and for dependent children when they are living

out of state.

2024

EMPLOYEE BENEFIT SUMMARY

12

In addition, Cigna offers member discounts on

fitness, nutrition, and weight management

programs. For more information on discounts,

visit the MCPS Well Aware web page and

navigate to the Discounts tab.

Kaiser Permanente HMO

Kaiser Permanente brings your doctors,

specialists, pharmacy, labs, X-rays, and medical

facilities under one plan. There are more than 33

medical centers within the MCPS service area.

Included are 14 Urgent Care locations, six of

which are Advanced Urgent Care centers open

24/7. You have the choice of more than 1,600

physicians in 50+ specialties from which to

choose. You may receive information about

locations at www.kp.org/locations or by

telephoning 1-800-777-7902. Medical centers

are staffed by doctors, nurses, and specialists

and offer a wide range of services such as

pharmacy, laboratory, X-ray, ambulatory

surgery, and health education. We encourage

you to select a center and PCP that best meets

your needs when you enroll in the plan. If you

do not choose a center, Kaiser Permanente

automatically will assign a center nearest to your

residence of record. You may change your

doctor anytime.

When scheduling an appointment, be sure to ask

for your PCP. You may call and change your

PCP or medical center location at any time.

Each of your covered family members may

select a center and PCP of their choice. Your

PCP is responsible for coordinating all health

needs including hospital and specialty care if

needed. If you enroll in the Kaiser Permanente

HMO, your prescription drug benefits and

diabetic supplies are provided under this plan.

Kaiser Permanente covers diabetic supplies and

provides certain discount specialty services.

Refer to the HMO comparison chart for more

information about the HMO plans.

PREVENTIVE CARE SERVICES

As a result of the Patient Protection and

Affordable Care Act, certain preventive care

procedures no longer will have copays when

they are provided by in-network providers,

regardless of your medical plan choice. The

specific procedures provided for adults and

children are listed separately in the following

charts. Preventive care procedures not listed

specifically will be covered by in-network

providers with copays outlined in the HMO and

POS comparison charts on the following pages.

Out-of-network coverage remains unchanged,

and copays are listed in the POS comparison

chart later in this document.

2024

EMPLOYEE BENEFIT SUMMARY

13

Preventive Services Covered with Zero Copay for Adults*

Preventive Service Covered Who is Eligible, Additional Details

Abdominal Aortic Aneurysm Screening one-time screening for men of specified ages who have ever smoked

Alcohol Misuse Screening and Counseling all adults

Aspirin Use men and women of certain ages

Blood Pressure Screening all adults

Cholesterol Screening adults of certain ages or at higher risk

Colorectal Cancer Screening adults over 50

Depression Screening all adults

Type 2 Diabetes Screening adults with high blood pressure

Diet Counseling adults at higher risk for chronic disease

HIV Screening

all adults at higher risk

Immunizations for:

Hepatitis A

Hepatitis B

Herpes Zoster

Human Papillomavirus

Influenza

Measles, Mumps, Rubella

Meningococcal

Pneumococcal

Tetanus, Diphtheria, Pertussis

Varicella

doses, recommended ages, and recommended populations vary

Obesity Screening and Counseling all adults

Sexually Transmitted Infection (STI) Prevention Counseling adults at higher risk

Tobacco Use Screening all adults and cessation interventions for tobacco users, expanded

counseling for pregnant tobacco users

* Using in-network providers only

2024

EMPLOYEE BENEFIT SUMMARY

14

Preventive Services Covered with Zero Copay for Women *

Preventive Service Covered Who is Eligible, Additional Details

Annual well-woman visit all women

Syphilis Screening all pregnant women, all adults at higher risk

Anemia Screening pregnant women, on a routine basis

Bacteriuria Urinary Tract or Other Infection Screening pregnant women

BRCA Counseling about Genetic Testing women at higher risk

Breast Cancer Mammography Screenings women over 40, every 1 to 2 years

Breast Cancer Chemoprevention Counseling women at higher risk

Breast Feeding Interventions women (to support and promote breast feeding)

Breast Feeding Support, Supplies, and Counseling women (to support and promote breast feeding)

Cervical Cancer Screening sexually active women

Chlamydia Infection Screening younger women and other women at higher risk

Contraceptive Methods and Counseling (FDA-approved**),

including:

Female Condom (OTC)

Diaphragm (P) with Spermicide (OTC)

Sponge (OTC) with Spermicide (OTC)

Cervical Cap (P) with Spermicide (OTC)]

Spermicide (OTC)

Oral Contraceptive (P)

Combined Pill

Progestin

Extended/Continuous

Patch (P)

Vaginal Contraceptive Ring (P)

Shot/Injection (P)

Morning After Pill (over 17 years of age OTC; under

17 years of age P)

IUD (P)

Implantable Rod (inserted by doctor)

Sterilization Surgery

Sterilization Implant

(OTC) Over the Counter

(P) Prescription Required

all women

Folic Acid Supplements women who may become pregnant

Gonorrhea Screening all women at higher risk

Gestational Diabetes Screening pregnant women

Hepatitis B Screening pregnant women at their first prenatal visit

Human Immunodeficiency Virus (HIV) Counseling and

Screening

all women, on an annual basis

Human Papillomavirus (HPV) Testing all women

Interpersonal and Domestic Violence Screening and

Counseling

all women

Osteoporosis Screening women over age 60 depending on risk factors

Rh Incompatibility Screening all pregnant women and follow-up testing for women at higher risk

Sexually Transmitted Infections Counseling all women, on an annual basis

* Using in-network providers only

** Includes surgical, prescription, medical, and OTC services/products. Sterilization is considered a contraceptive method.

Abortion IS NOT considered a contraceptive method.

2024

EMPLOYEE BENEFIT SUMMARY

15

Preventive Services Covered with Zero Copay for Children*

Service Who is Eligible, Additional Details

Alcohol and Drug Use Assessments adolescents

Autism Screening children at 18 and 24 months

Behavioral Assessments children of all ages

Cervical Dysplasia Screening sexually active females

Congenital Hypothyroidism Screening

newborns

Developmental Screening

children under age 3, and surveillance throughout childhood

Dyslipidemia Screening children at higher risk of lipid disorders

Fluoride Chemoprevention Supplements children without fluoride in their water source

Gonorrhea Preventive Medication for the Eyes all newborns

Hearing Screening all newborns

Height, Weight, and Body Mass Index Measurements children of all ages

Hematocrit or Hemoglobin Screening children of all ages

Hemoglobinopathies or Sickle Cell Screening newborns

HIV Screening adolescents at higher risk

Immunization Vaccines for:

Diphtheria, Tetanus, Pertussis

Haemophilus Influenzae Type B

Hepatitis A

Hepatitis B

Human Papillomavirus

Inactivated Poliovirus

Influenza

Measles, Mumps, Rubella

Meningococcal

Pneumococcal

Rotavirus

Varicella

children from birth to age 18; doses, recommended ages, and

recommended populations vary

Iron Supplements children ages 6 to 12 months at risk for anemia

Lead Screening children at risk of exposure

Medical History all children, available throughout development

Obesity Screening and Counseling children of all ages

Oral Health Risk Assessment young children

Phenylketonuria (PKU) Screening for Genetic Disorder newborns

Sexually Transmitted Infection (STI) Prevention Counseling adolescents at higher risk

Tuberculin Testing children at higher risk of tuberculosis

Vision Screening children of all ages

* Using in-network providers only

2024

EMPLOYEE BENEFIT SUMMARY

16

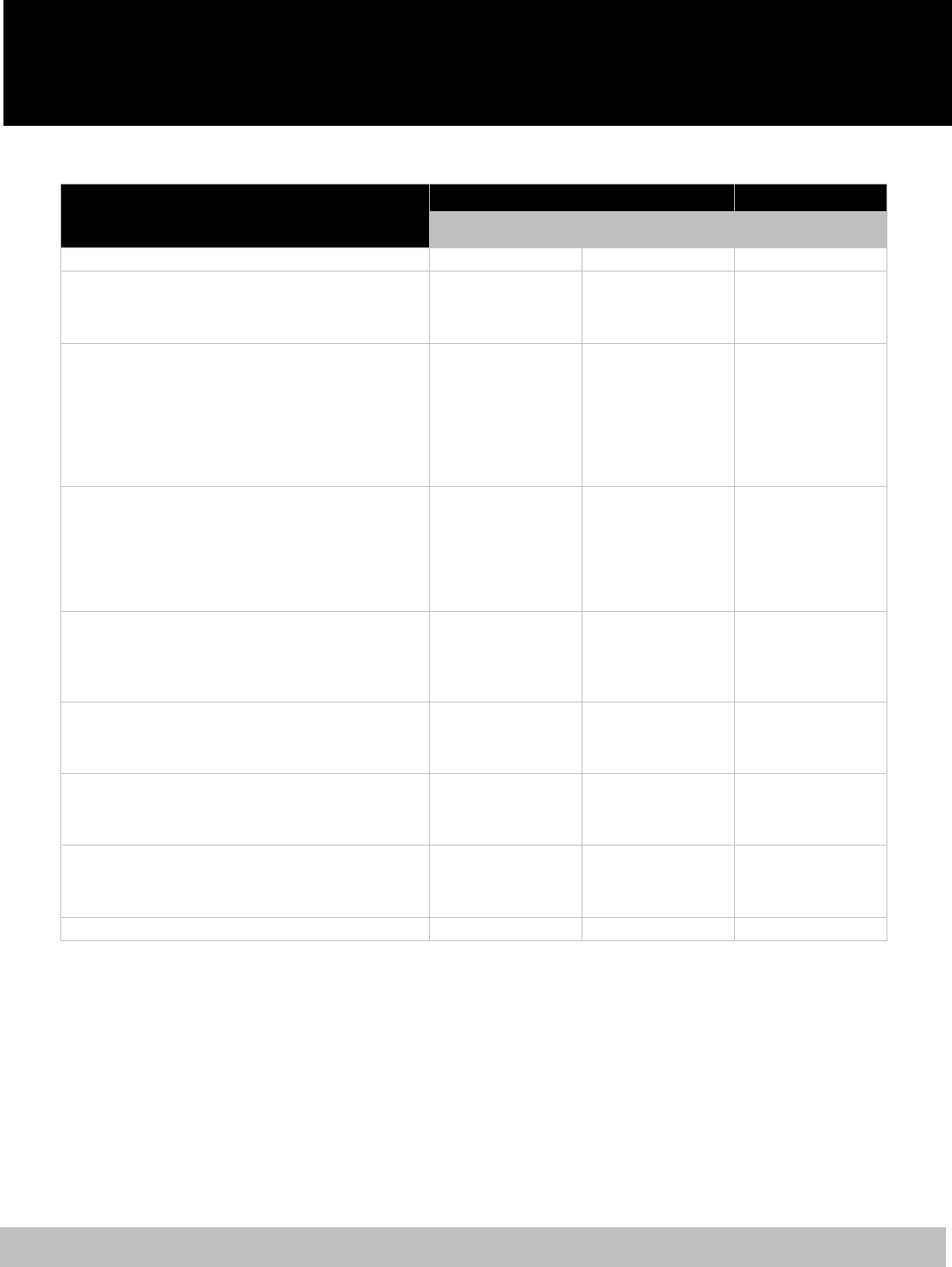

Health Maintenance

Organization (HMO) Plans

Kaiser Permanente HMO Plan

Cigna Open Access Plus

In-Network (OAPIN) Plan

Annual Deductible None None

Preventive Care

Routine Physical Exam Covered in full Covered in full

Well Baby/Child Care Covered in full (under age 5) Covered in full

Childhood Immunizations Covered in full (under age 5) Covered in full

Physician Services

Physician Office Visit $10 copay $10 copay

Specialist Office Visit $20 copay $20 copay

Lab Work and X-rays Covered in full Covered in full

Allergy Shots $10 copay

$10 copay

$20 specialist copay

Maternity Care

Prenatal and Postnatal Care

$10 copay, no charge once pregnancy is

confirmed*

Covered in full

Physician Services Covered in full $10 copay

Hospital Services Covered in full Covered in full

Emergency Services (when medically necessary)

Urgent Care Centers $20 copay $20 copay

Emergency Room $150 copay (waived if admitted) $150 copay (waived if admitted)

Emergency Physician

Services

Covered in full Covered in full

Emergency Ambulance Covered in full if authorized Covered in full

Hospital Services—Inpatient

Semi-Private Room Covered in full Covered in full

Professional Services Covered in full Covered in full

Surgical Procedures Covered in full Covered in full

Specialty Care/ Consultation Covered in full Covered in full

Anesthesia Covered in full Covered in full

Radiology and Drugs Covered in full Covered in full

Intensive Care Covered in full Covered in full

Coronary Care Covered in full Covered in full

Hospital Services—Outpatient

Surgical Procedures $20 copay $20 copay

Professional Fees Covered in full $10 copay/$20 copay for specialist

Mental Health/Substance Abuse Services

Inpatient Days Covered in full Covered in full

Outpatient Visits $10 copay $10 copay

Other Services

Catastrophic Illness Covered in full Covered in full

Durable Medical Equipment Covered in full You pay 25%

Home Health Care Covered in full Covered in full

Hospice Care Covered in full Covered in full

Skilled Nursing Care Covered in full up to 100 days per contract year Covered in full

*Applies to services not specifically listed in the previous preventive care charts.

2024

EMPLOYEE BENEFIT SUMMARY

17

Open Point-of-Service (POS) Plan

Cigna Open Access Plus (OAP) Plan

In-Network Out-o

f

-Network

Annual Deductible None

$300 individual,

$600 family

Preventive Care

Routine Physical Exam $15 copay* Not covered

Well Baby/Child Care $15 copay* 80%, no deductible

Childhood Immunizations Covered in full 80%, no deductible

Physician Services

Physician Office Visit $15 copay 80% after deductible

Specialist Office Visit $25 copay 80% after deductible

Lab Work and X-rays Covered in full

Diagnostic: 80% after deductible

Routine: not covered

Allergy Evaluations $15 copay each visit 80% after deductible

Allergy Shots Covered in full 80% after deductible

Maternity Care

Prenatal and Postnatal Care $25 copay first visit, covered in full after* 80% after deductible

Physician Services Covered in full 80% after deductible

Hospital Services Covered in full 80% after deductible

Emergency Services (when medically necessary)

Urgent Care Centers $25 copay $25 copay, then plan pays 80%

Emergency Room $150 copay (waived if admitted) $150 copay (waived if admitted)

Emergency Physician Services Covered in full Covered in full

Emergency Ambulance Covered in full Covered in full

Hospital Services—Inpatient

Semi-Private Room Covered in full 80% after deductible

Professional Services Covered in full 80% after deductible

Surgical Procedures Covered in full 80% after deductible

Specialty Care/ Consultation Covered in full 80% after deductible

Anesthesia Covered in full 80% after deductible

Radiology and Drugs Covered in full 80% after deductible

Intensive Care Covered in full 80% after deductible

Coronary Care Covered in full 80% after deductible

Hospital Services – Outpatient

Surgical Procedures Covered in full 80% after deductible

Professional Fees Covered in full 80% after deductible

Mental Health/Substance Abuse Services

Inpatient Days Covered in full 80% after deductible

Outpatient Visits $15 copay 80% after deductible

Other Services

Catastrophic Illness Covered in full

Covered in full after $1,000 out-of-pocket expenses

(excludes deductible)

Durable Medical Equipment** Covered in full 80% after deductible

Home Health Care/

Skilled Nursing Care

Covered in full 80% after deductible

(Up to 60 visits for both in- and out-of-network)

Hospice Care Covered in full 80% after deductible

*Applies to services not listed in the previous preventive care charts.

**Does not include diabetic supplies such as lancets, glucose strips, etc.

2024

EMPLOYEE BENEFIT SUMMARY

18

Other Benefit Plan

Coverage

In addition to medical coverage, you may

choose dental, vision, and prescription drug

coverage when you enroll (see the appropriate

section in this document for details). Base rates

for the 2024 plan year, which do not include

Wellness Initiatives credit(s), are included in this

document. Rates that factor in Wellness Initiatives

credits are available during the plan year at

https://www2.montgomeryschoolsmd.org/depart

ments/ersc/employees/benefits/

You are responsible for updating beneficiary

designations for your life insurance plans, the

state and county pension plans, and the defined

contribution plans [403(b) and 457(b)]. You may

update life insurance beneficiary(ies) during

Open Enrollment or if you experience a

qualifying life event during the plan year, by

visiting the Employee Self-Service web page at

https://www2.montgomeryschoolsmd.org/depart

ments/ersc/employees/employee-self-service/ and

selecting the appropriate link under the blue My

Benefits banner. Pension plan forms are

available on the ERSC website. To change your

defined contribution plan beneficiaries, contact

Fidelity directly at 800-343-0860 or

www.netbenefits.com/MCPS.

Dental Coverage

If you are eligible for benefits, you may choose

from the following dental plans:

CareFirst Dental Plan (PPO),

Aetna Dental Maintenance Organization

(DMO), or

Kaiser Permanente medical plan members are

automatically enro

lled in the Kaiser Permanente

dental plan. They have the option of also

enrolling in either the PPO plan or DMO plan.

You may change dental plans only during Open

Enrollment or if a DMO participant and you

move outside of the Aetna DMO service area.

CareFirst Preferred Dental Plan

(PPO)

If you enroll in the CareFirst Dental PPO plan,

you have the freedom to select the dentist of

yo

ur choice. This plan offers in- and out-of-

network benefits.

You can access in-network provider information

by calling 1-888-755-2657 or visiting

CareFirst’s website at

www.carefirst.com/mcps.

Under Find a Doctor, click Search Now.

Log in to My Account.

Select Dental.

Search by Name or Specialty.

You receive a higher level of benefits if you

receive dental services from a participating (in-

network) PPO dentist. If you receive dental

services from a non-participating (out-of-

network) dentist, you receive a less generous

level of benefits. Reimbursement is based on the

schedule of dental benefits and is subject to

deductibles, copays, and reasonable and

customary charges. Prophylaxis, including

scaling and polishing, is covered up to two times

per calendar year.

Orthodontic benefits are available to dependent

children of active employees only if they were

Important Notice

New employees eligible for benefits are enrolled in the

basic term life insurance plan automatically. You will need

to designate a beneficiary for basic life insurance when you

enroll in benefits via the BES. If you wish to decline basic

term life insurance coverage, you must do so online by

electing “decline” life insurance coverage. See the Life

Insurance section of this document for additional details.

You may update your life insurance beneficiaries at any

time by using the BES. Make sure to update beneficiary

designations as your circumstances change.

2024

EMPLOYEE BENEFIT SUMMARY

19

enrolled in the MCPS plan and younger than age

20 when the treatment began. The in-network

orthodontic benefit is 50 percent of the allowed

charge, and the out- of-network orthodontic

benefit is 30 percent of the allowed charge.

There is a maximum lifetime orthodontic benefit

of $1,000 per child (in- or out-of-network).

Aetna Dental Maintenance

Organization (DMO)

If you wish to enroll in the Aetna DMO plan,

you should contact Aetna directly to verify that

you reside in the DMO service area. As a DMO

participant, you must select a primary dentist

from a list of participating DMO dentists and be

on the dentist’s roster before your first

appointment. To obtain information and select

a participating DMO provider, visit Aetna’s

website at www.aetna.com/docfind or call

1-800-843-3661.

The Aetna DMO does not require you to meet an

annual deductible before benefits are paid, and

there is no maximum annual benefit limitation.

However, benefits are paid only if you receive

care from a dentist who is part of the DMO

network. Benefits are paid at a certain

percentage (100 percent for preventive or basic

or 75 percent for major).

Orthodontic benefits are available to dependent

children of active employees only if they were

enrolled in the MCPS plan and younger than age

20 when the treatment began. The orthodontic

benefit is 50 percent of the scheduled fee,

limited to one full treatment per eligible child.

There is no lifetime maximum.

Refer to the chart on the next page for more

information about your dental options.

Kaiser Permanente Dental Plan

The Kaiser Permanente medical and prescription

plan includes a schedule of benefits for in-

network dental care for both adult and pediatric

patients. Participants pay $30 for a dental exam

and cleaning. More extensive care is offered at

fixed fees lower than the usual and customary

charges for dental services. For more information

visit DominionNational.com/KaiserDentists.

This coverage is not available to those who are

not Kaiser Permanente members.

Refer to the chart on the next page for more

information about your PPO and DMO dental

options. For details about the Kaiser Permanente

dental plan, visit

www.montgomeryschoolsmd.org/departments/er

sc/employees/benefits/health/medical/kaiser.aspx

and click on the Evidence of Coverage link.

2024

EMPLOYEE BENEFIT SUMMARY

20

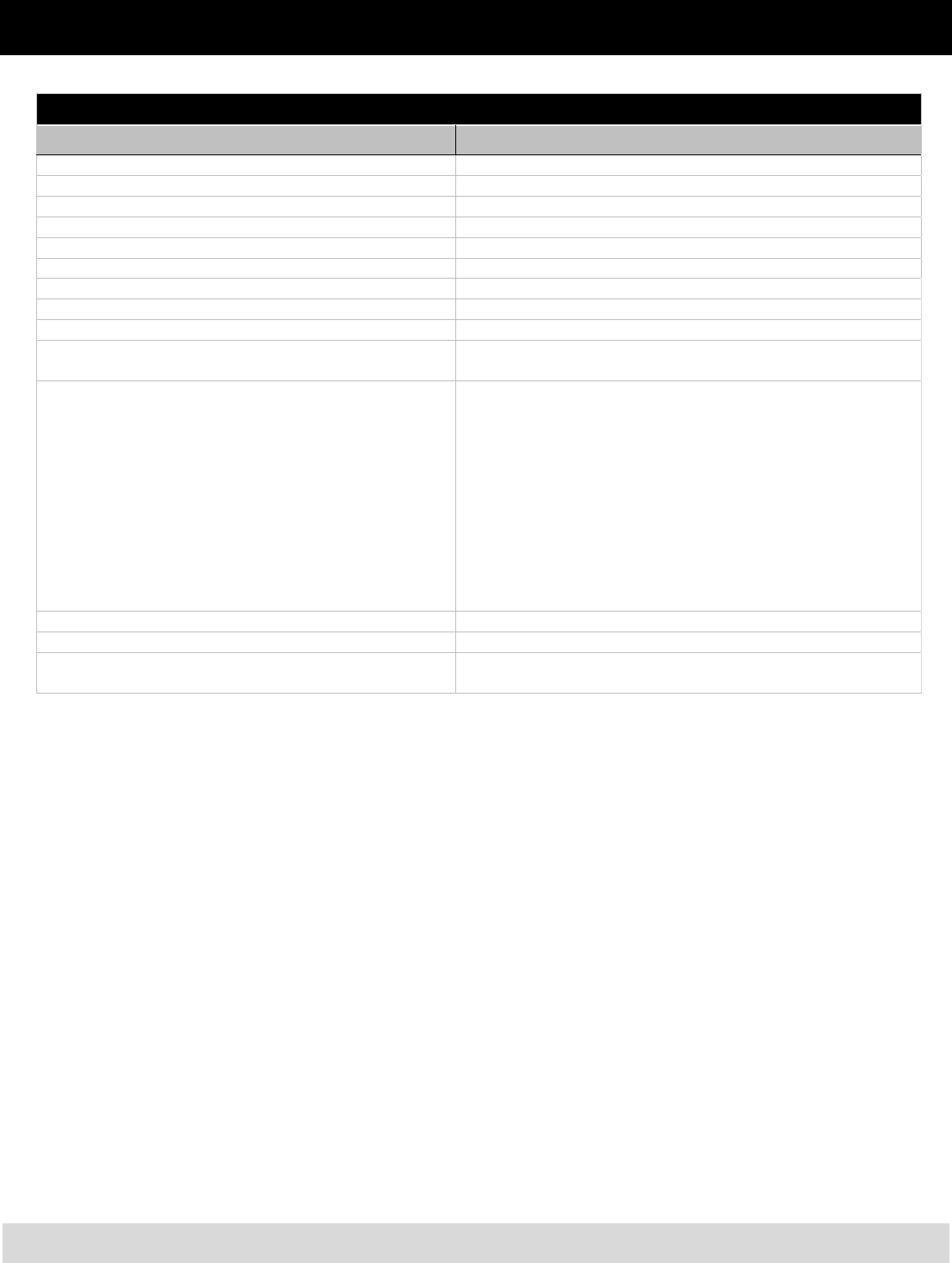

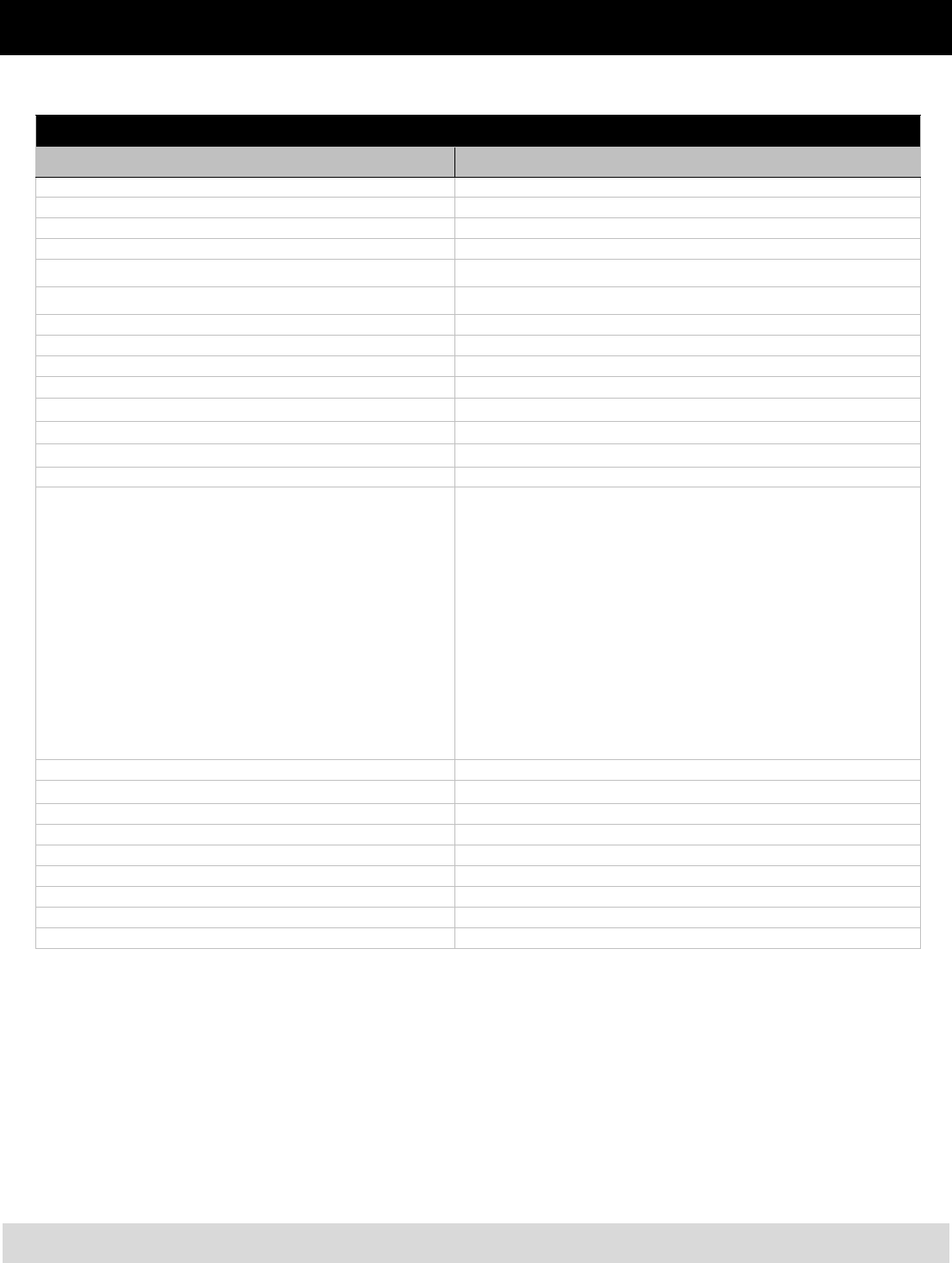

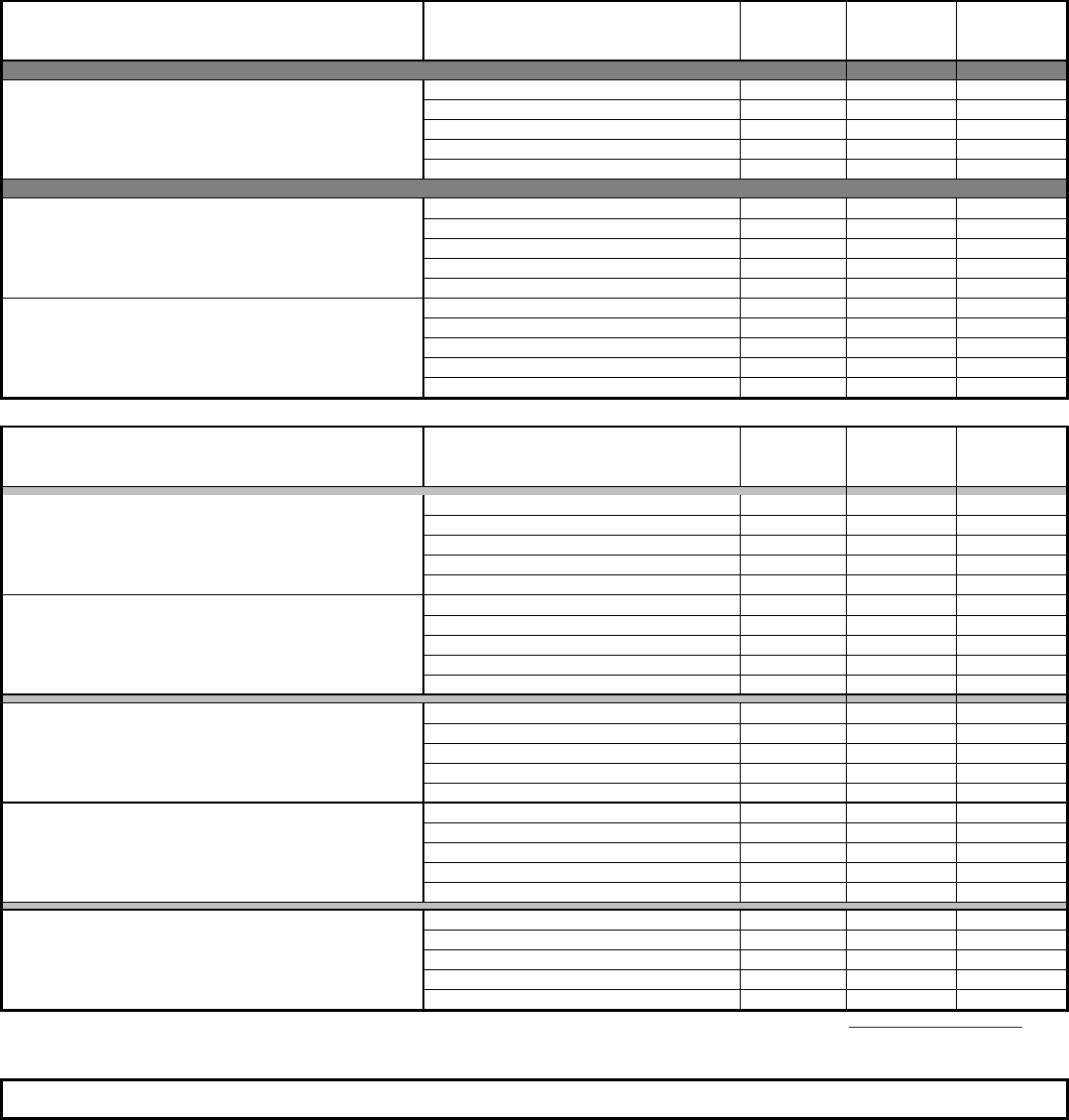

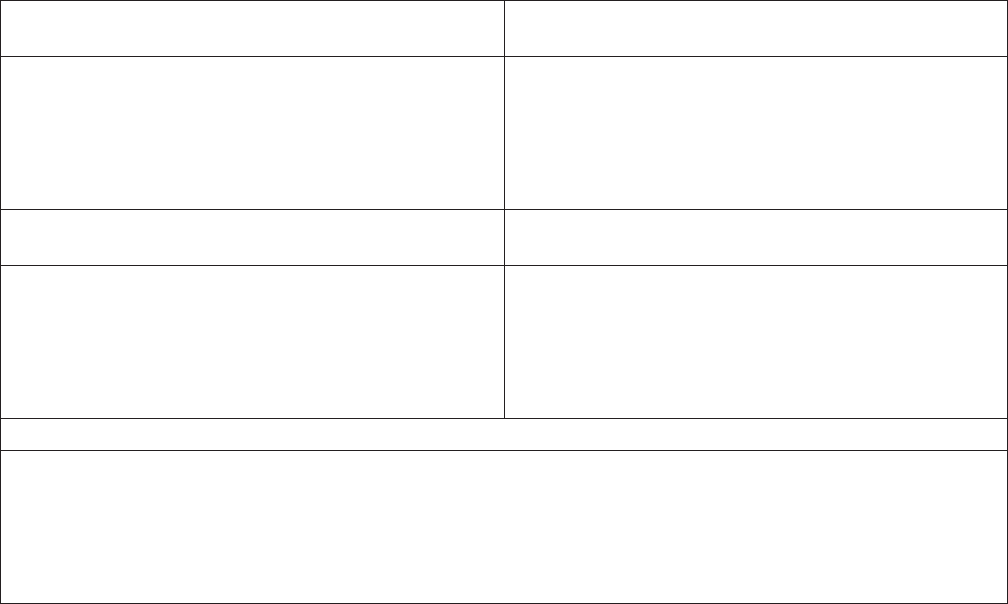

Dental Benefits

CareFirst PPO Aetna DMO

In-Network

Plan pays:

Out-of-Network

Plan pays:

In-Network Only

Plan pays:

Maximum Annual Benefit* $2,000 $2,000 None

Annual Deductible

Class I

Class II

Class III

None

$50

$50

None

$100

$100

None

None

None

Diagnostic (Class I)

Routine exams

X-rays

Prophylaxis (includes scaling and polishing)

Fluoride (one treatment per year up to age 18)

Sealants (one treatment every three years on permanent

molars only under age 16)

Oral Hygiene Instruction

100%

Oral Hygiene

Instruction not covered

80%

Oral Hygiene

Instruction not covered

100%

Basic (Class II)

Amalgam

Composite Filling (anterior tooth only)

Pulp Capping

Root Canal Therapy with X-rays and Cultures (other than

molar root canal)

Scaling and Root Planing

100% 80% 100%

Basic (Class II)

Space Maintainers

Molar Root Canal Therapy

Osseous Surgery (periodontal surgery)