Who Is Minding the Nanny Tax?

Brian Erard (B. Erard & Associates, LLC)

1

1. Introduction

Households are generally responsible for ling and remitting various Federal and State employment taxes,

commonly subsumed under the moniker “the Nanny Tax,” when they employ domestic help, such as a nanny,

senior caregiver, housekeeper, health aide, cook, or gardener. e largest of these taxes are the Federal Social

Security and Medicare taxes administered under the Federal Insurance Contributions Act (FICA), which are

applied at a combined rate of . percent to the wages of any household employee who is paid more than ,

over the course of a year. Household employers are also responsible for Federal unemployment taxes adminis-

tered under the Federal Unemployment Tax Act (FUTA) when they pay their employees more than , in

any quarter of the current or preceding calendar years. FUTA tax is normally applied at a rate of . percent of

wages.

Besides these Federal taxes, a household employer is generally required to remit certain State payroll

taxes. In addition to State unemployment insurance contributions, these payroll taxes may include disability

and/or workers’ compensation insurance, depending on the State where the work is performed.

Failure to pay the Nanny Tax has resulted in numerous high-prole scandals involving political appointees

of every U.S. president from Clinton to Trump. is ongoing parade of “Nannygate” cases is symptomatic of

a pervasive, but understudied, compliance problem.

3

Improving our understanding of Nanny Tax evasion is

important, not only because it is a potentially signicant source of Federal and State revenue leakage, but also

because of its adverse implications for a particularly vulnerable class of workers that is predominantly female,

relatively less educated, and generally of limited means. Among those who are legally authorized to work, the

Nanny Tax serves as the pathway through which domestic workers access unemployment insurance, Social Se-

curity, Medicare, and other employment-related benets. Being paid over the table also helps domestic work-

ers to establish the credit needed to rent an apartment, purchase a car, obtain a mortgage, or secure a personal

loan. At the same time, all the various labor market and social issues that surround the topic of illegal immigra-

tion are relevant, because a sizeable share of unauthorized immigrants support themselves and their families

by providing personal services to households. Compliance with the Nanny Tax involves important interactions

between a relatively well-o segment of the population and a relatively poor segment. ese interactions are

complicated by an inadequate understanding among both segments regarding their rights and responsibilities.

In this study, we perform a systematic and detailed analysis of the extent to which household employers

fail to comply with their Federal Nanny Tax obligations. We nd evidence of pervasive noncompliance. Ac-

cording to our estimates, only 5.3 percent of household employers le Schedule H (Household Employment

Taxes) with their individual income tax returns and remit the required payroll taxes for their domestic em-

ployees. Overall, only $1.1 billion in payroll taxes were remitted with Schedule H in 2015, leaving an estimated

revenue gap of between $2.4 billion and $4 billion. Evidence from Consumer Expenditure Survey data on

household expenditures for childcare in one’s own home suggests that the higher end of this range is quite

plausible. When domestic workers are paid under the table, they are unlikely to pay income tax on their earn-

ings. We estimate that the failure to report earnings from domestic work results in a Federal individual income

tax gap of at least $979 million and likely closer to double this amount. ese estimates do not even account for

unpaid State-level obligations of household employers for unemployment, disability, and workers’ compensa-

tion insurance or the unpaid State income tax obligations of their employees.

1

is study (based on Erard (2018)) was sponsored by the International Nanny Association (INA). e views expressed herein are my own and do not necessarily

reect those of the INA. I am grateful to Kim Bloomquist, Tom Breedlove, Marcia Hall, Alan Heilbron, Laura Kawano, Guy Maddalone, Megan Metzger, Bryan

O’Malley, Alan Plumley, Tonya Sakowicz, Jay Schulze, Aileen ompson, Kathy Webb, and the participants at the 2018 IRS-TPC Research Conference for their

helpful comments.

2

e FUTA tax rate is higher for employers who do not make timely State unemployment tax payments as well as for employers who reside in a credit reduction

State.

3

For those interested in delving into other research on Nanny Tax compliance, see the excellent studies conducted by Bloomquist & An (2006) and Haskins (2010).

Erard

e remainder of this study is organized as follows. Section 2 reviews the historical trend in Schedule H

lings, which points to a large and growing problem with Nanny Tax compliance. Section 3 provides a prelimi-

nary, albeit incomplete, picture of the domestic employee workforce based on Current Population Survey data

on individuals who report that their longest job during the year was as a private household worker. Even this

partial picture reveals evidence of a substantial compliance problem. In Section 4, we extend our analysis to

account for individuals who moonlight as domestic workers and individuals who were employed as a private

household worker for only a portion of the year (and who worked more hours at a dierent job). Accounting

for these workers is challenging because we rely on the monthly Current Population Survey, which asks about

employment status only at a point in time (the survey reference week).

In Section 5, we exploit the longitudinal sampling design of this survey to translate our point-in-time

count of domestic workers into a count of individuals who worked for a private household at least for a por-

tion of the year. In Section 6, we address several other measurement issues, including survey undercount of

foreign-born residents, domestic workers with earnings below the Schedule H ling threshold, and domestic

workers who have multiple employers (and hence are potentially associated with a separate Schedule H l-

ing requirement among each of their employers). Aer accounting for these issues, we derive our estimate of

Federal payroll tax ling noncompliance among household employers, which indicates that extremely few

household employers comply with their ling requirements.

In Section 7, we develop estimates of the Federal payroll tax gap among household employers as well as

the Federal individual income tax gap among household employees. Our estimates indicate a massive level of

noncompliance. In Section 8, we examine statistics on household expenditures for in-home childcare based

on the Consumer Expenditure Survey. e consistency of these reported expenditures with our estimates of

domestic childcare worker earnings provides support for our Nanny Tax gap estimates. In Section 9, we sum-

marize the demographic characteristics of domestic workers who are mostly female, and about 46 percent are

foreign-born residents. e foreign-born domestic workers are almost evenly split between lawful and unlaw-

ful immigrants. In Section 10, we propose measures that the IRS should undertake to begin closing the Nanny

Tax gap. Section 11 concludes.

2. Schedule H ling trend

Nanny Tax compliance became a subject of national attention and Congressional scrutiny following the with-

drawal of Zoë Baird’s nomination for Attorney General in stemming from revelations that she had illegal-

ly employed unauthorized immigrants as domestic workers and had also failed to le and remit the required

payroll taxes.

e ensuing investigations exposed that Nanny Tax evasion was, in fact, a widespread problem.

Only approximately , household employers led and remitted payroll taxes in (New York Times

News Service ()).

According to IRS estimates, this group of lers represented less than one-fourth of all

household employers with a Federal payroll tax obligation (H.R. Rep. No. -, ).

At that time, a household employer was required to le Form 942 (Employer’s Quarterly Return for House-

hold Employees) to report and remit Social Security and Medicare taxes for any domestic worker who was paid

more than $50 in cash wages during the calendar quarter. In addition, a separate annual ling of Form 940

was required to report and remit applicable FUTA taxes.

5

Schedule H was introduced in Tax Year 1995 as a

measure to reduce the Federal compliance burden faced by household employers and to improve their com-

pliance. Under the new law, the employer now had to submit only a new form (Schedule H) with his annual

individual income tax return to report all Federal payroll taxes for his domestic employees (including Social

Security, Medicare, and FUTA taxes).

6

As well, the $50 quarterly threshold for Social Security and Medicare

taxes was replaced by an ination-indexed annual threshold of $1,000, and babysitters under the age of 18 were

exempted from all payroll tax requirements.

7

4

Although it is against the law for a household employer to hire an unauthorized immigrant, the employer remains subject to all tax withholding, reporting, and

remittance requirements, regardless of whether its employees have proper work authorization.

5

A quarterly remittance of FUTA taxes was required for employers who owed more than $100 at the end of a calendar quarter.

6

Household employers continue to have a requirement to report wages annually on Forms W-2 and W-3, and they must obtain an employer identication number

(EIN).

7

An exception is that babysitters under the age of 18 who are not students and for whom childcare is their primary occupation are subject to Federal payroll taxation.

Children under age the age of 21 who are paid by their parents to babysit are also exempt from payroll taxes. Babysitting of grandchildren by grandparents is also

generally exempt.

Who Is Minding the Nanny Tax?

Although it was hoped that, by simplifying and streamlining the ling process, tax compliance would im-

prove over time, the immediate outcome was that roughly 200,000 fewer household employers led and remit-

ted payroll taxes for Tax Year 1995–a 40-percent drop in lings. e reasons underlying this substantial decline

are unclear. Certainly, some household employers no longer had a ling requirement owing to the increased

ling threshold. However, few of the aected employers had been ling Form 942 in any case under the previ-

ous regime (Committee on Ways and Means (1993) p. 49). Under the new regime, household employers had

to arrange for quarterly estimated tax payments (or request an increase in the amount of tax withheld by their

own employers) to avoid a large combined payroll and income tax balance at the end of the year. Perhaps some

of the employers who were caught o guard by this change may have omitted Schedule H from their returns

to sidestep the unexpected tax obligation.

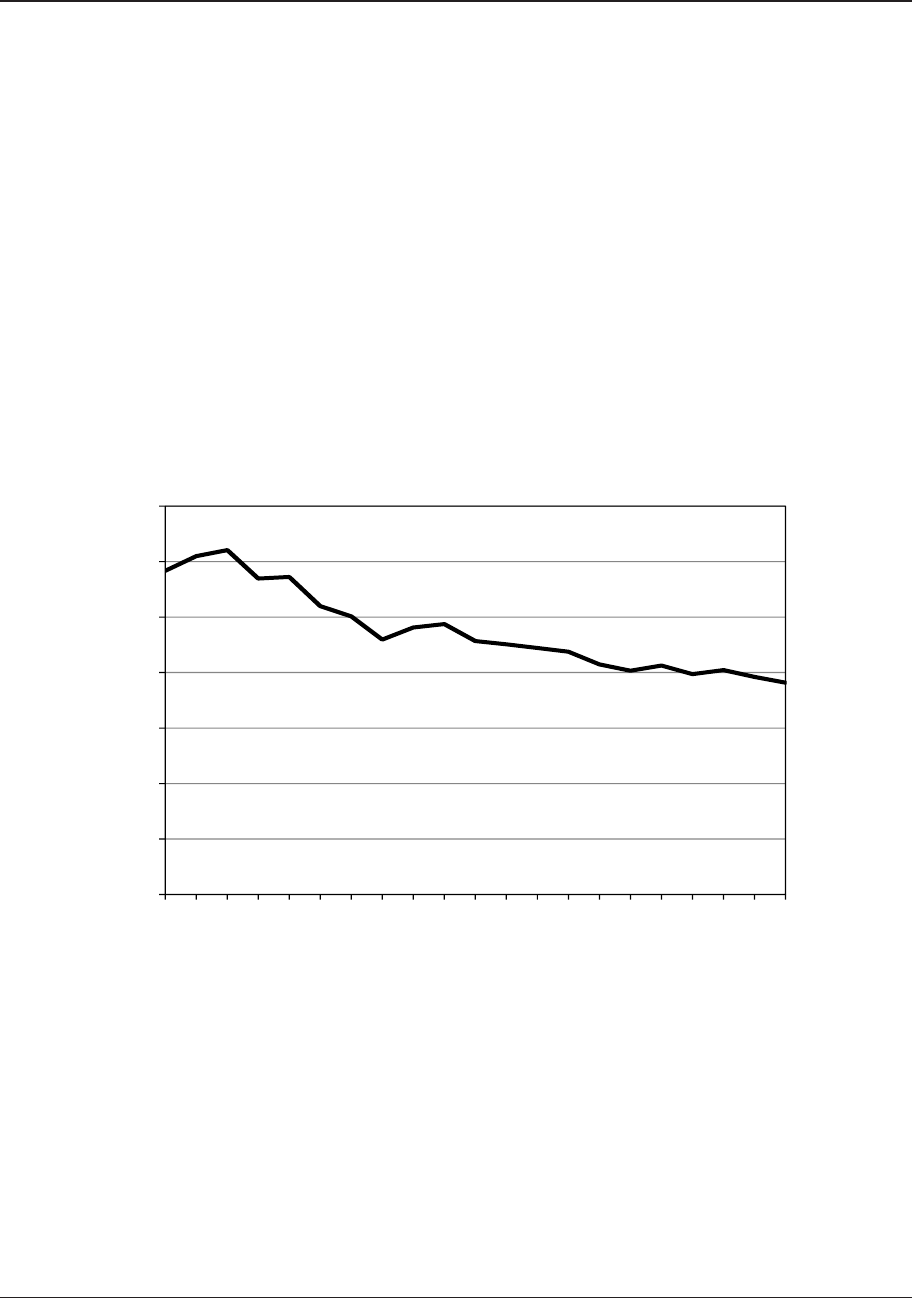

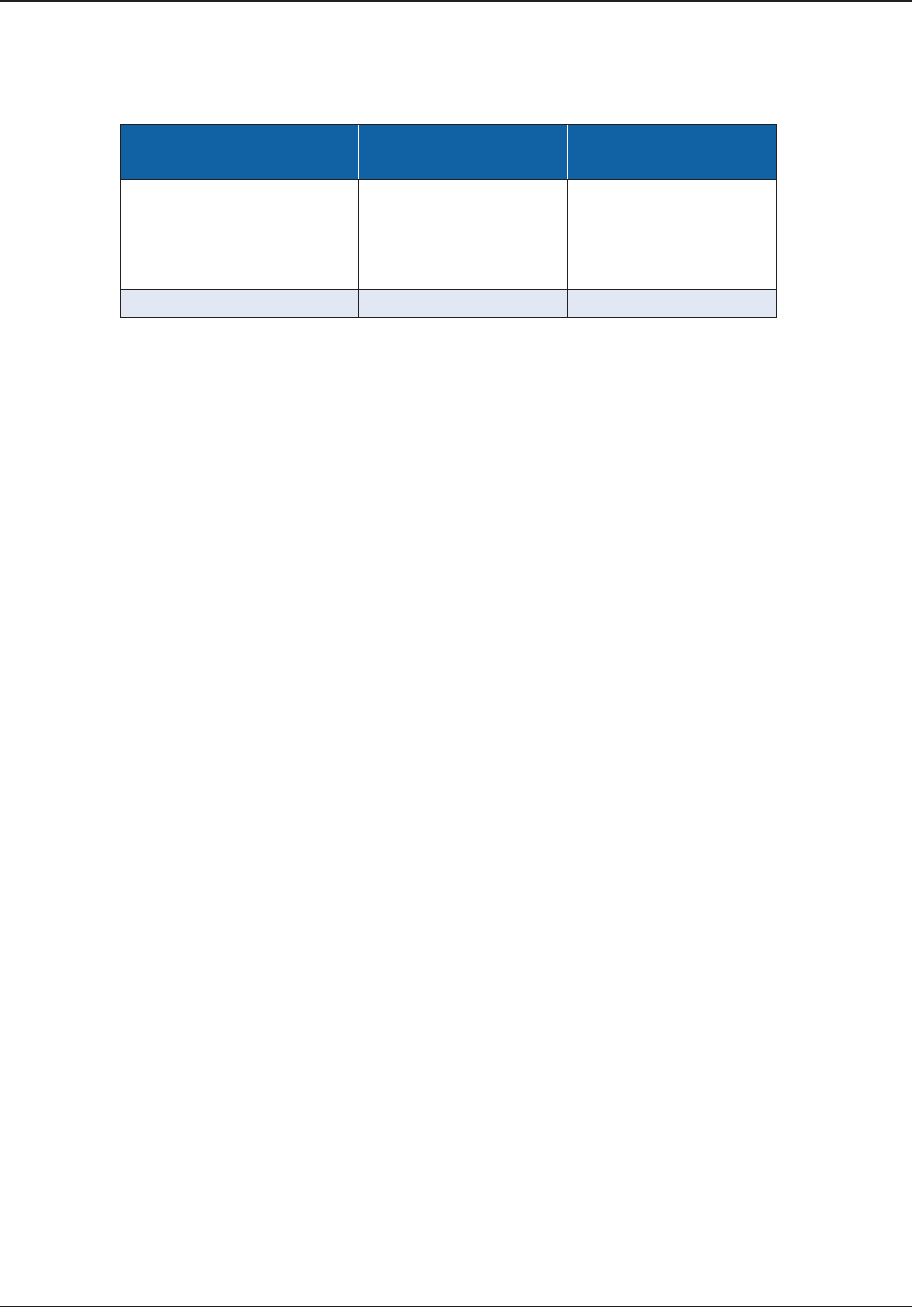

As shown in Figure 1, Schedule H lings grew only modestly over the next 2 years, with lings peaking at

about 310,000 in Tax Year 1997. From that year on, Schedule H lings have declined precipitously, falling to

slightly fewer than 191,000 by Tax Year 2015.

8

As Bloomquist & An (2006) and Haskins (2010) have previously

noted from this emerging trend, the sharp decline in Schedule H lings reects a large and growing compli-

ance problem.

FIGURE 1. Schedule H lings, Tax Years 1995–2015

0

50

100

150

200

250

300

350

1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015

Thousands of Schedule H Filings

Tax Year

3. Domestic work as a main job

One can obtain an initial, albeit incomplete, picture of the domestic employee workforce from the Annual

Social and Economic Supplement of the Current Population Survey (CPS-ASEC). is annual survey collects

socio-economic and demographic information for more than , members of a multistage probability

sample of over , U.S. households each year. e information collected includes comprehensive details

regarding employment and earnings associated with one’s longest-held job during the preceding calendar year.

Domestic workers are assigned to the four-digit industry category (Private Household Workers) in the

CPS-ASEC, which corresponds to the three-digit North American Industry Classication System (NAICS)

industry category .

8

Filing statistics were obtained from the annual IRS Statistics of Income Individual Income Tax Returns, Publication 1304, for Tax Years 1995-2015 (Internal

Revenue Service (1997-2017)).

Erard

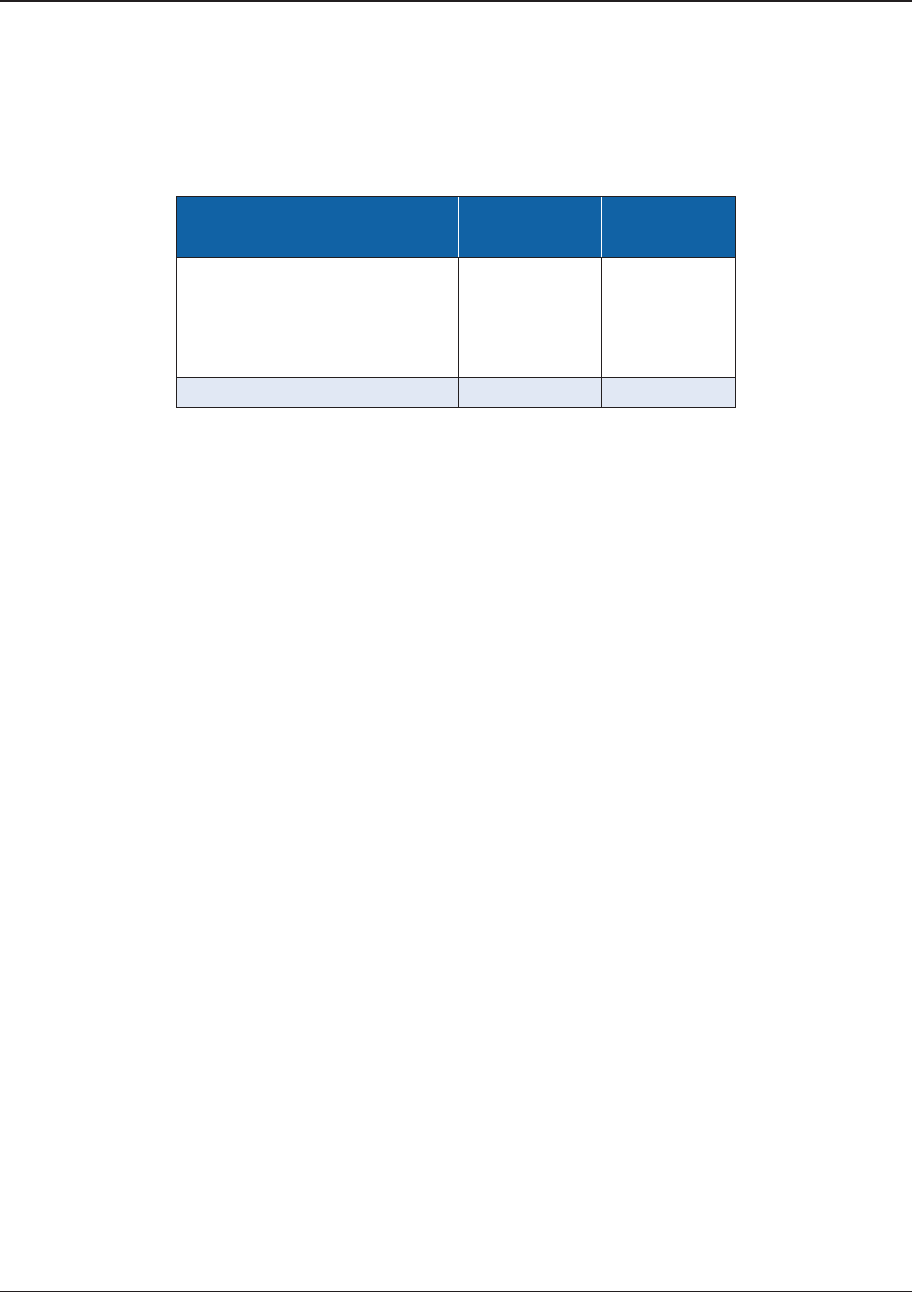

As indicated in Table 1, almost three-quarters of a million workers over the age of 17 had a longest-held

job in this industry in 2015.

9

Over three-quarters of those were maids/housekeepers or childcaregivers.

TABLE 1. Individuals over age 17 who were employed

as domestic workers in their longest-held job in 2015

Occupation

Number of

Employees

Percentage

of Total

Maid/Housekeeper 342,613 46.7%

Child Caregiver 223,640 30.5%

Personal Home Care Aide 116,903 15.9%

Other Miscellaneous 50,488 6.9%

Total 733,645 100.0%

Based on their reported earnings, over 637,000 of these 734,000 domestic workers earned more than the

Tax Year 2015 Nanny Tax threshold of $1,900. us, even if we were to restrict our attention to one’s longest-

held job during the year and assumed that each domestic employee had a single household employer, we

would conclude that at least 637,000 household employers were potentially subject to Federal Nanny Tax ling

requirements for Tax Year 2015. erefore, the fact that fewer than 191,000 Schedule H returns were led for

this year points to a serious compliance problem.

Below, we undertake a more comprehensive analysis to obtain a clearer picture of the actual scope of the

problem. To the extent possible, we exploit data on moonlighters and job changers, survey undercounts of

unauthorized immigrants, and industry classication challenges to estimate the degree to which household

employers comply with Federal ling and remittance requirements. We also estimate the amount of Federal

individual income tax that goes unpaid by their employees on their earnings. Our estimates, while conserva-

tive, indicate massive noncompliance. We conclude by oering some suggestions for improving compliance.

4. Accounting for moonlighters and job changers

e analysis presented in Section was restricted to workers who reported that their longest-held job in

was as a domestic employee. erefore, it did not account for individuals who moonlighted as domestic work-

ers or those who worked for a household employer for a portion of the year but worked for a longer portion of

the year at a dierent job. To address these issues, we rely on the monthly Current Population Survey (CPS).

Under the monthly survey program, socio-economic and demographic information is collected regarding ap-

proximately , residents from a multistage probability sample of roughly , households from the

overall civilian noninstitutional population. Information on the main job held during the prior week is col-

lected for all individuals over the age of . Table presents the weighted monthly counts of all individuals

over the age of who reported working as a domestic employee on their main job in .

e counts range

from about , to ,, depending on the survey month. e weighted average count across months

is approximately ,. is gure is larger than the CPS-ASEC estimate of , individuals with a

longest-held job as a domestic worker in . is makes sense, because the monthly CPS gures reect the

main job held by an individual during the reference week, which is not necessarily the longest-held job over

the course of the year.

e monthly CPS survey also asks about any work performed on a second job during the prior week for

about one-fourth of all individuals over the age of 15 (the “outgoing rotation group”). e weighted average

9

e CPS-ASEC and monthly CPS public-use les were retrieved from the National Bureau of Economic Research (NBER) Website: http://www.nber.org/cps/.

10

ese counts include individuals who either were employed (regardless whether present or absent from work in the prior week) or on layo.

Who Is Minding the Nanny Tax?

number of individuals who reported holding a second job as a domestic employee during the survey reference

week (but not their main job) in 2015 is 68,861. us, an average of almost 859,000 individuals reportedly held

either a main or a second job as a domestic employee in any given month of 2015.

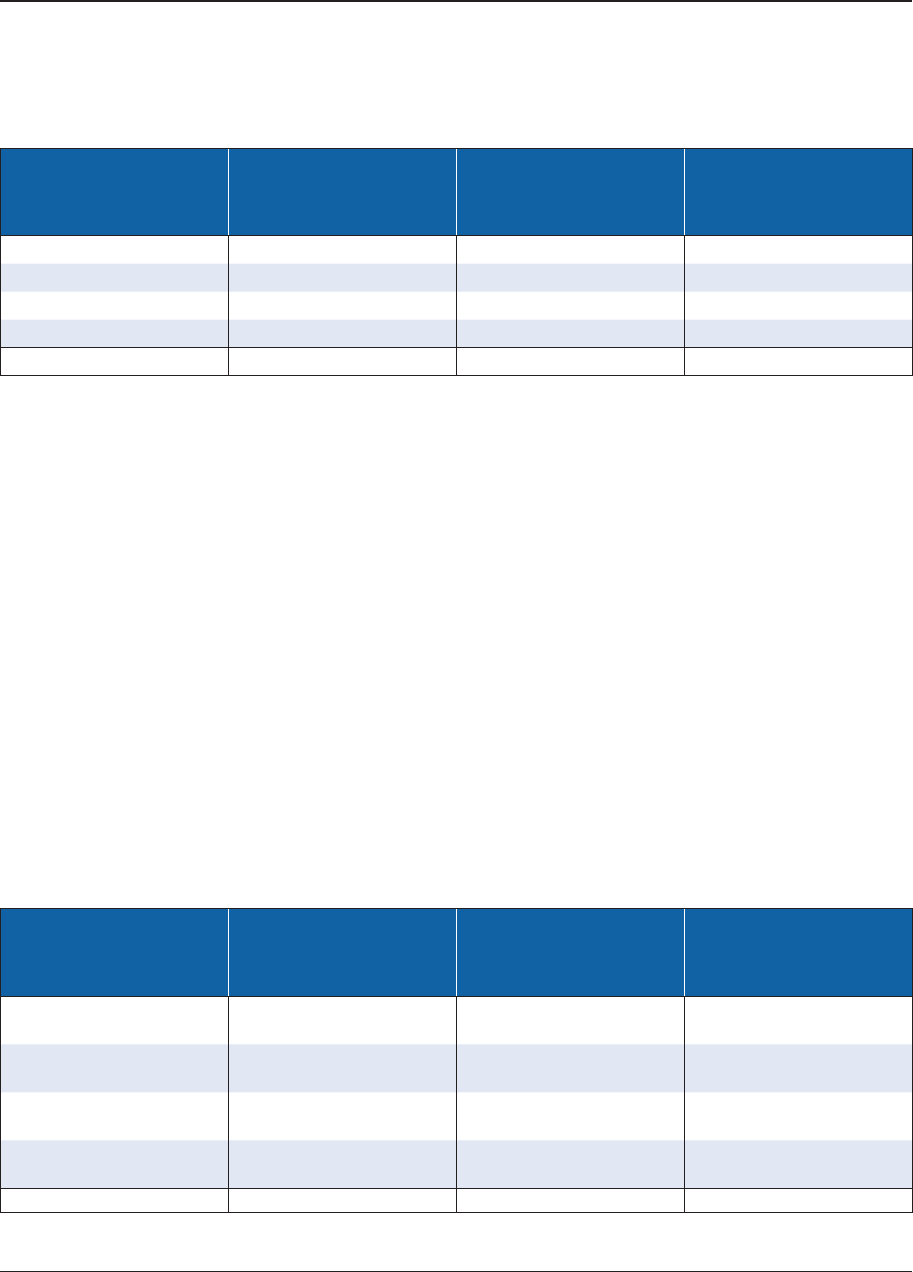

TABLE 2. Weighted monthly counts of

domestic workers over age 17 in 2015

based on main job held in prior week

Month

Number of

Workers

January 922,107

February 824,581

March 782,102

April 786,073

May 754,253

June 843,771

July 765,204

August 807,014

September 718,653

October 799,012

November 745,001

December 730,612

Weighted Average 789,858

A limitation of these monthly gures is that they capture employment status only at a single point in time

during the year. Consequently, they fail to identify individuals who worked as a domestic employee over a por-

tion of the year, but not during the survey reference week. is issue is addressed below in Section 5.

5. Adjusting for point-in-time measurement limitations

To examine the extent to which the monthly CPS point-in-time measures of domestic employment from

Section understate the number of individuals who worked at least a portion of the year as domestic workers,

we take advantage of the longitudinal nature of the CPS sampling design. e monthly survey includes eight

panels or rotation groups, with two new groups brought into rotation each month and two retired. Households

in each rotation group are interviewed once a month for consecutive months and then are interviewed again

during the same months of the subsequent year. By appropriately matching individuals across the monthly

surveys, one can therefore identify how an individual’s employment status varies over dierent months. To

perform these matches, we have relied on the matching variable “CPSIDP” provided by IPUMS-USA (see

King, et al. ()) as well as the CPS measures of reported gender, race, and age. By matching individuals

across the monthly surveys conducted in , we can observe a given individual’s employment status up to

a maximum of four times, depending on the rotation group of the household and other factors.

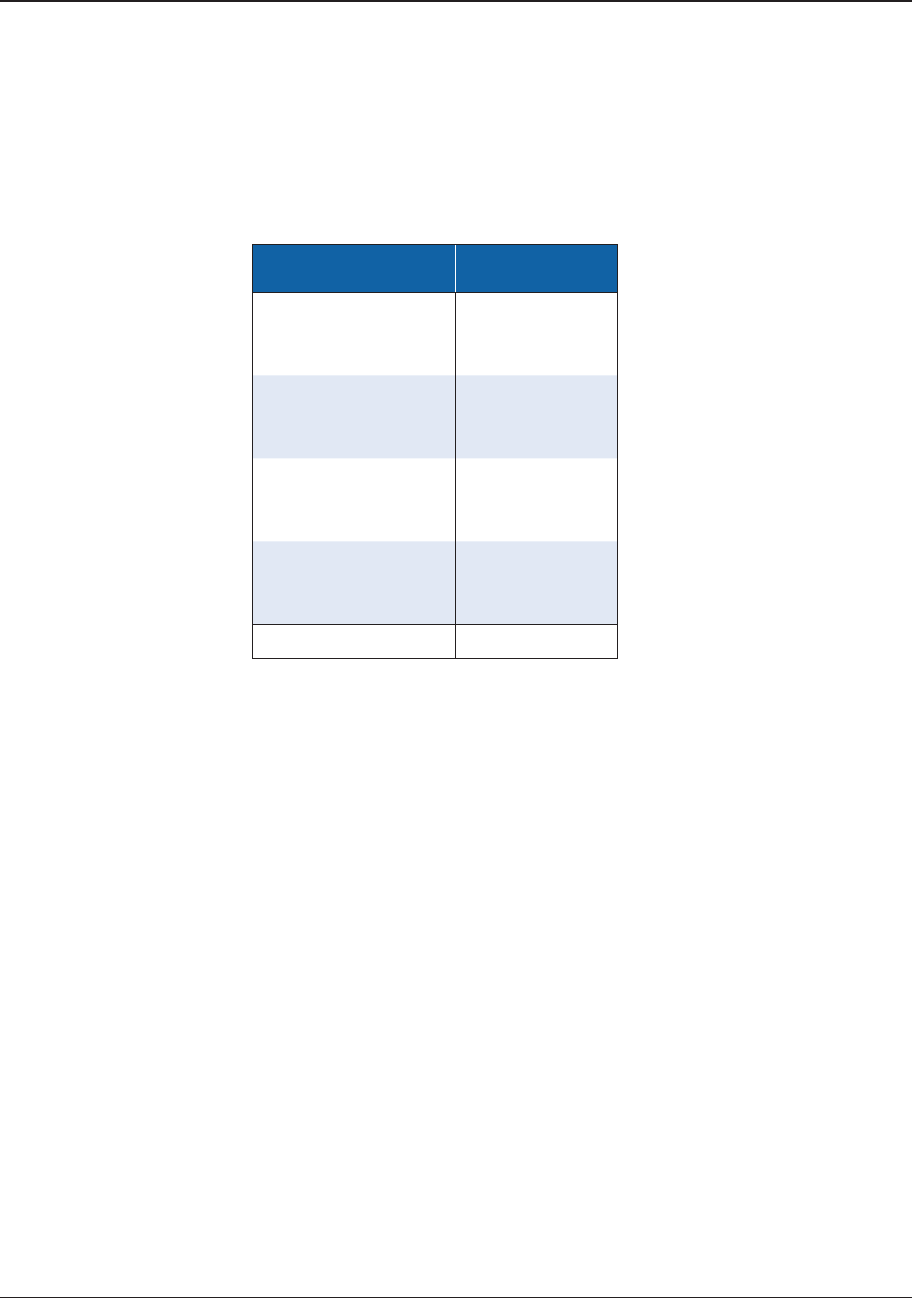

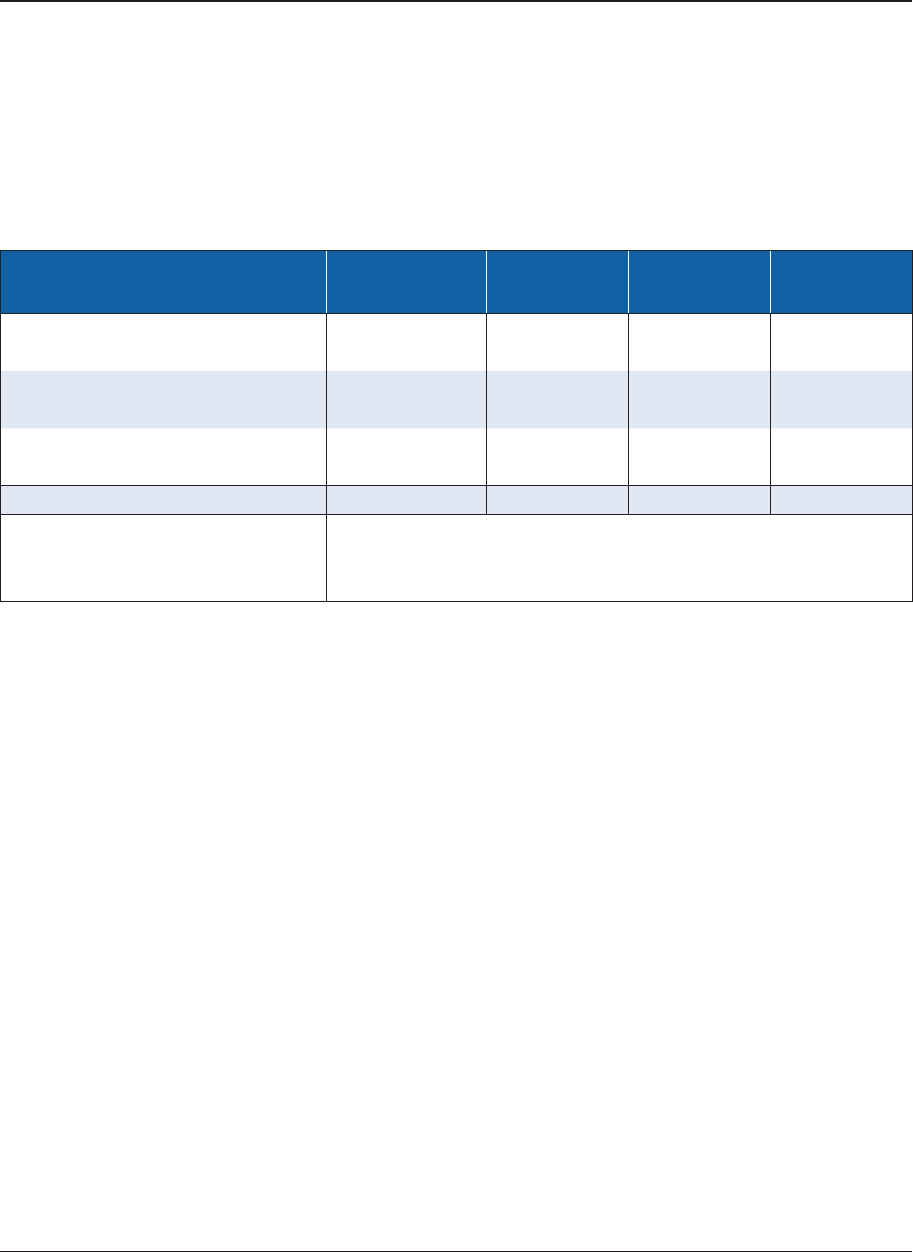

Table 3 breaks down our sample of 387,094 matched survey respondents over the age of 17 by the number

of consecutive months that they were interviewed in 2015.

11

In addition, it is not possible to denitively match all individuals across the relevant monthly samples, owing to changes in household composition, sample

attrition, and occasional coding errors in the data samples; however, the success rate is quite high.

Erard

TABLE 3. Unweighted frequencies of consecutive CPS monthly surveys

in 2015 among matched individuals over age 17

Number of Monthly Surveys Frequency Percentage of Total

1 60,310 15.6%

2 52,296 13.5%

3 61,165 15.8%

4 213,323 55.1%

Total 387,094 100.0%

Rather than rely on a measure of whether an individual worked in a domestic occupation during the refer-

ence period of a single monthly survey, we would ideally like to employ a measure of whether the individual

worked in a domestic occupation at any time during the year. As a step in that direction, we have computed the

weighted average number of individuals who reported domestic work as their main job during any of the one,

two, three, or four periods that they were subject to a CPS monthly survey in 2015.

12

is yielded an estimate of

1.19 million domestic workers, which is almost 34 percent higher than the previous estimate of 790,000 based

on the weighted average number of respondents who reported having been employed as a domestic worker

in their main job in a given survey month. Even this 1.19-million-worker estimate substantially understates

the actual number of individuals who were employed as domestic workers at some point over the course of

the entire year, because the respondent reported only his or her employment status on 4 or fewer consecutive

monthly surveys during the 12-month period.

To better understand the limitations of relying on a single point-in-time measurement to infer employ-

ment status over a period spanning many months, consider the subsample of 1,001 individuals who were the

subject of 4 separate monthly surveys during 2015 and who reported employment as a domestic worker in at

least 1 of these 4 months. Each member of this subsample reported domestic employment status in 1, 2, 3, or

4 of the months. Column (A) of Table 4 breaks down the weighted percentage frequency associated with each

of these outcomes.

All members of this subsample were employed in a domestic occupation for at least a portion of the

4-month interval over which they received the surveys. However, many of these individuals would be over-

looked if one were to rely on a single monthly survey to reect a respondent’s employment status over the

entire interval. For instance, Column (A) indicates that approximately one-third of the subsample reported

having held a domestic job during only 1 of the 4 monthly surveys. erefore, only 1 of the 4 monthly surveys

(or 25 percent of the surveys) provides an indication that a member of this group was a domestic worker for at

least a portion of the 4-month interval. Likewise, only 50 percent of the 4 monthly surveys correctly reect this

status among the 17-percent share of the subsample that reported domestic employment in 2 of the 4 interview

months, and only 75 percent of the 4 monthly surveys correctly reect this status among the 13-percent share

of the subsample that reported domestic employment in 3 of the 4 interview months. e correct status would

be consistently assigned in each month only for the 37-percent share of the subsample that reported domestic

employment during all 4 monthly surveys. erefore, if assignment of domestic employment status were based

on individual monthly responses, members of the overall subsample would be correctly assigned as having

been employed as a domestic worker at some point over the 4-month interval only about 63 percent of the

time. In other words, the actual count of individuals who served as domestic workers for at least some portion

of the 4-month interval would be understated by approximately 37 percent.

12

For this calculation, each individual sample weight was computed as the sum of the weights across the months that the individual was sampled, divided by 12.

Who Is Minding the Nanny Tax?

TABLE 4. Weighted percentage of months with correct assignment of domestic-worker

status over 4 months in 2015 by number of monthly reports of domestic employment during

reference period, individuals over age 17

Number of Monthly

Reports of Domestic

Employment

Weighted Percentage

Frequency

(A)

Percentage of Months

Correctly Assigned as a

Domestic Worker

(B)

(A) Times (B)

1 33.34% 25% 8.3%

2 16.96% 50% 8.5%

3 12.82% 75% 9.6%

4 36.88% 100% 36.9%

Total 100.00% N/A 63.3%

N/A: Not applicable

e reason that the previously-mentioned panel-based estimate implies a somewhat smaller percentage

understatement (34 percent) is that some respondents were interviewed over fewer than 4 consecutive month-

ly surveys. In such cases, the respondents were assigned to domestic-worker status based on their employment

status over an interval of shorter than 4 months, thereby misrepresenting their true status over the entire

4-month period in some instances.

In practice, we would like to estimate the number of individuals who served as a domestic worker over

any portion of 2015, not just during an interval of 4 consecutive months during the year. To obtain a better

sense of the extent to which assignment based on individual monthly responses leads to an understatement

of this count, we have extended the CPS panel to include members of the monthly surveys from July 2014

through June 2016. Over this period, a given individual would have been included in up to 8 monthly surveys.

Table 5 repeats the analysis presented in Table 4 for the 463 individuals who participated in 8 monthly surveys

over this period. e results indicate that if our objective were to obtain a (weighted) count of the number of

these individuals who held a job as a domestic worker over at least a portion of the 8 interview months, as-

signment based on the individual monthly responses would understate the actual count by approximately 58

percent, meaning that the true count would be roughly 2.4 times as large as the computed count.

13

TABLE 5. Weighted percentage of months with correct assignment of domestic worker status

over 8 survey months between July 2014 and June 2016 by number of monthly reports of

domestic employment during reference period, individuals over age 17

Number of Monthly

Reports of Domestic

Employment

Weighted Percentage

Frequency

(A)

Percentage of Months

Correctly Assigned as a

Domestic Worker

(B)

(A) Times (B)

1 31.52% 12.5% 3.94%

2 12.93% 25.0% 3.24%

3 11.24% 37.5% 4.22%

4 21.71% 50.0% 10.86%

5 1.83% 62.5% 1.14%

6 4.05% 75.0% 3.04%

7 6.73% 87.5% 5.89%

8 9.99% 100.0% 9.99%

Total 100.00% N/A 42.30%

N/A: Not applicable

13

From Table 5, the overall chance of correctly identifying private household worker status is only 42.3 percent, implying an understatement of approximately 58

percent. Note that if we instead wanted to estimate the number of individuals who held a job as a domestic worker over at least a portion of the full 16-month

period, this adjustment factor would be too small, because it implicitly assumes that anyone with this status would have been working as a domestic employee

at some point during the 8 interview months, ignoring those who worked as a domestic employee only at some time during the 8 noninterview months. In

fact, the adjustment factor also does not take into account that the monthly interview covers only a 1-week reference period, thereby ignoring the possibility of

employment as a domestic worker during 1 or more weeks of the interview month, but excluding the reference week.

Erard

is analysis involving individuals who were surveyed during 8 dierent months at least approximates

the ideal situation in which individuals are surveyed in each month of a given year. Overall, it is reasonable to

assume that 2.4 is a conservative adjustment factor for translating our weighted average CPS monthly count

of individuals who worked as domestic employees during the reference week into an estimated count of indi-

viduals who worked at least a portion of Calendar Year 2015 as domestic employees. Applying this adjustment

factor to our initial count of 859,000 individuals who worked as domestic employees in their main or second

job during the reference week yields an estimated count of 2.06 million individuals who held a domestic job

during at least a portion of 2015.

6. Additional adjustments

In this section we address the issues of survey undercount of foreign-born residents, domestic workers with

annual earnings below the Schedule H ling threshold, and domestic workers with multiple household em-

ployers. Aer accounting for these issues, we compare our estimate of the number of required Schedule H

lings in to the actual number of lings. e results suggest that only about percent of all household

employers comply with their Federal payroll tax obligations.

6.1 Survey undercount

Foreign-born residents are disproportionately represented within the domestic worker population. At the same

time, they are underrepresented in national surveys, such as the CPS and the American Community Survey

(ACS). To address this undercount problem, we rely on Pew Research Center estimates (DeSilver ();

Passel and Cohn ()), which suggest that foreign-born private household workers are undercounted by

approximately . percent. Applying this adjustment factor to foreign-born domestic workers in the monthly

CPS samples modestly increases our overall estimate from Section from . million domestic workers in

Calendar Year to approximately . million.

6.2 Annual earnings below Schedule H ling threshold

Although , is a rather modest annual earnings threshold for a Schedule H ling requirement, not all

. million workers would have reached this threshold. Aer adjusting for undercount of foreign-born resi-

dents, our estimate based on CPS-ASEC is that , of the roughly , individuals ( percent) whose

longest-held job in was as a private household worker had domestic employment earnings of more than

,. Multiplying . million by this percentage yields an estimated . million domestic workers associated

with at least one Schedule H ling requirement.

6.3 Domestic workers with multiple employers

Table breaks down by occupation this overall estimate of . million individuals over the age of who

earned more than , from a main or second job as a domestic worker in . As the combined CPS

monthly sample size is quite large, it is feasible to provide a somewhat more detailed breakdown of occupation

categories than was possible with the CPS-ASEC sample in Table . e occupation shares based on the main

and second job presented in Table are quite similar to those presented in Table for the longest-held job over

the course of the year. Again, the highest shares are associated with maids/housekeepers (. percent), child-

caregivers (. percent), and personal home care aides (. percent). Nurses and home health aides, cooks

and food preparation workers, and other domestic occupations, such as gardeners and drivers, account for the

remaining . percent.

Since many domestic workers are employed by multiple households, the number of required Schedule H

returns is expected to be much larger than 1.82 million. For instance, it is common for housekeepers to clean

14

is adjustment for survey undercount is conservative. A recent study by Fazel-Zarandi, Feinstein, and Kaplan (2018) suggests that the undercount rate is much

larger.

15

We believe that this is a conservative estimate owing to the reluctance of domestic workers who are paid under the table to disclose the true amount of their

earnings on a survey or even acknowledge that they had employment earnings at all. See the discussion in Section 8.

Who Is Minding the Nanny Tax?

many dierent homes over the course of a week. As well, many childcare providers work in temporary or

nanny-sharing arrangements over the course of the year. Table 6 includes a conservative estimate of the aver-

age number of employers for whom dierent occupations of domestic employees work, based on gures that a

Nanny Tax preparation service has shared with us concerning its actual client experience.

16

TABLE 6. Number of domestic employees, average number of employers, and estimated

number of required Schedule H lings by occupation

Occupation

Number of

Domestic Workers

Percentage

Frequency

Average #

Employers

Total #

Employers

Maid/Housekeeper 834,111 45.8%

3.0

2,502,332

Child Caregiver 549,214 30.1% 1.5 823,821

Personal Home Care Aide 298,698 16.4% 1.1 328,568

Nurse/Therapist/Health Aide 32,818 1.8% 1.1 36,100

Cook/Food Prep. Worker 13,857 0.8% 1.1 15,242

Other Miscellaneous 93,734 5.1%

1.1

103,108

Total 1,822,432 100.0% 2.1 3,809,171

Actual Number of Schedule H Filings

190,852

Required Number of Schedule H Filings 3,619,000*

Schedule H Filing Rate

5.3%

* Accounts for employers with multiple domestic employees during the year

Applying these gures, we estimate that these 1.82 million domestic employees had approximately 3.8

million household employers. However, the required number of Schedule H lings would be somewhat fewer

than 3.8 million, because household employers with more than one employee over the course of the year are

required to make only a single Schedule H ling.

17

To address this issue, we adjust our estimate downwards by

5 percent (to 3.6 million) based on client statistics on the share of Schedule H lings covering more than one

employee that were provided to us by a Nanny Tax preparation service.

Since only about 191,000 Schedule H returns were led for Tax Year 2015, we estimate a ling compliance

rate of only 5.3 percent, which is roughly comparable to the dismal level of compliance that States currently

experience with respect to their consumer use taxes.

7. Federal payroll and individual income tax gaps

In this section we develop an estimate of the tax gap associated with payroll taxes that go unreported by

household employers. Oen, when domestic workers are paid cash wages under the table, they fail to report

the individual income tax on these earnings. We therefore also provide an estimate of the potential individual

income tax gap among domestic employees.

7.1 Payroll tax gap

To estimate the Federal payroll taxes for which household employers are responsible, it is necessary to estimate

the annual earnings of their employees. Aggregate reported earnings were . billion (, per worker)

among those CPS-ASEC respondents over the age of who indicated that their longest-held job in was

as a domestic worker and who had annual earnings over ,. is tabulation based on longest-held jobs

accounts only for , of the estimated . million individuals who worked at least a portion of the year

16

Household employers who use Nanny Tax preparation services are presumably more likely to have full-time permanent help than household employers who do

not use these services. As a result, these gures are likely to understate the overall number of household employers in the population who rely on part-time and

temporary workers.

17

A small number of household employers may choose instead to le Form 941 on a quarterly basis for their domestic employees. However, this is likely to be rare,

so that my estimates remain conservative.

Erard

as domestic employees. Social Security and Medicare taxes are applied at a combined rate of . percent. For

employers who make timely State unemployment insurance contributions and who do not reside in a credit

reduction State, the FUTA tax rate is . percent. erefore, the combined estimated payroll tax obligations for

these , domestic workers, alone, amount to more than . billion (. x . billion).

It is dicult to assess how the annual household employment earnings of individuals who moonlighted as

domestic workers or worked only a portion of the year in a private household setting (and worked a larger por-

tion of the year in a dierent job) compare to those who were employed as domestic workers on their longest-

held job. It seems plausible that they would have somewhat lower annual earnings from domestic employment.

On the other hand, individuals may be reluctant to acknowledge and divulge under-the-table earnings on a

survey, so it seems likely that our $17,822 estimate for average earnings from a longest held-job as a domestic

worker is, itself, understated. Consequently, $17,822 is perhaps too low a gure for those whose longest-held

job was as a domestic worker and perhaps too high a gure for those who worked as domestic workers in a

position dierent from their longest-held job. In Table 7, we employ $17,822 as an upper bound for the average

annual wage of individuals who worked as domestic employees outside of their longest-held job in 2015. is

would be an appropriate estimate if the above-described errors cancel out. For our lower bound estimate, we

make the more conservative assumption that average annual earnings for such workers are only half as large

($8,911) as the average reported annual earnings among those employed as private household workers in their

longest-held job. As shown in the table, these assumptions imply that aggregate required payroll taxes for those

working as domestic employees outside of the longest-held job in 2015 amounted to between $1.66 billion and

$3.32 billion. Adding in the estimated $1.84 billion in required payroll taxes for those who reported working as

domestic employees in their longest-held job, we arrive at a total payroll tax obligation of between $3.5 billion

and $5.2 billion for all domestic workers combined.

TABLE 7. Federal payroll tax gap among household employers, Tax Year 2015

Item

Longest-Held

Job

Other Job

Lower Bound

Other Job

Upper Bound

All Jobs

Lower Bound

All Jobs

Upper Bound

Number of Employees 649,337 1,173,095 1,173,095 1,822,432 1,822,432

Average Wages $17,822 $8,911 $17,822 $12,086 $17,822

Aggregate Wages ($ Billions) $11.57 $10.45 $20.91 $22.03 $32.48

Payroll Taxes Owed ($ Billions) $1.84 $1.66 $3.32 $3.50 $5.16

Payroll Taxes Remitted ($ Billions) $1.13 $1.13

Payroll Tax Gap ($ Billions) $2.37 $4.03

Compliance Rate 32.4% 22.0%

Household employers remitted only $1.13 billion in payroll taxes with Schedule H in Tax Year 2015, leav-

ing an estimated payroll tax gap of between $2.4 billion and $4 billion. In Section 8, we provide evidence from

the Consumer Expenditure Survey that supports an estimate closer to the upper end of this range.

7.2 Individual income tax gap

We have developed a CPS-ASEC tax calculator to estimate the net Federal individual income tax aer re-

fundable credits (specically, the Earned Income Credit and the Additional Child Tax Credit) for domestic

workers (and their spouses, in the case of joint ling status) both inclusive and exclusive of domestic employ-

ment earnings.

For the , individuals who report having a longest-held job during as a domestic

worker, we estimate that the average income tax liability amounted to , per worker when earnings from

domestic employment were included, but only per worker when these earnings were excluded. us, the

18

Unauthorized workers are not eligible for the Earned Income Credit (EIC). To address this, some foreign-born private household employees in our sample were

randomly assigned as unauthorized workers and were denied the EIC in our tax calculations.

Who Is Minding the Nanny Tax?

lion’s share of the overall tax bill (,) was attributable to their domestic employment earnings. Based on

these gures, domestic workers were subject to an average Federal income tax rate of . percent on those

earnings.

In Table 8, we apply this average tax rate estimate of 6.58 percent to the earnings of all domestic workers to

compute their aggregate tax liability.

20

Our calculations rely on the same lower and upper bound estimates of

earnings that were used to compute payroll taxes in Table 7. e results indicate that domestic workers owed

between $1.45 billion and $2.1 billion in aggregate income taxes on their employment earnings. We assume

that domestic workers paid their income taxes on these earnings only when their employers remitted the as-

sociated payroll taxes. In the previous subsection, payroll taxes were paid on 32.4 percent of earnings based on

the lower bound wage estimate and 22 percent based on the upper bound estimate. Under both the lower and

upper bound scenarios, this implies an aggregate income tax payment of approximately $470 million. Aer

deducting taxes paid from taxes owed, we arrive at an estimated Federal individual income tax gap ranging

from $979 million to $1.7 billion.

TABLE 8. Federal individual income tax gap (in $ Millions) associated

with domestic employment earnings, Tax Year 2015

Item Lower Bound Upper Bound

Aggregate Wages 22,030 32,480

Income Tax on Aggregate Wages 1,449 2,135

Amount of Tax Paid 470 470

Income Tax Gap 979 1,666

Compliance Rate 32.4% 22.0%

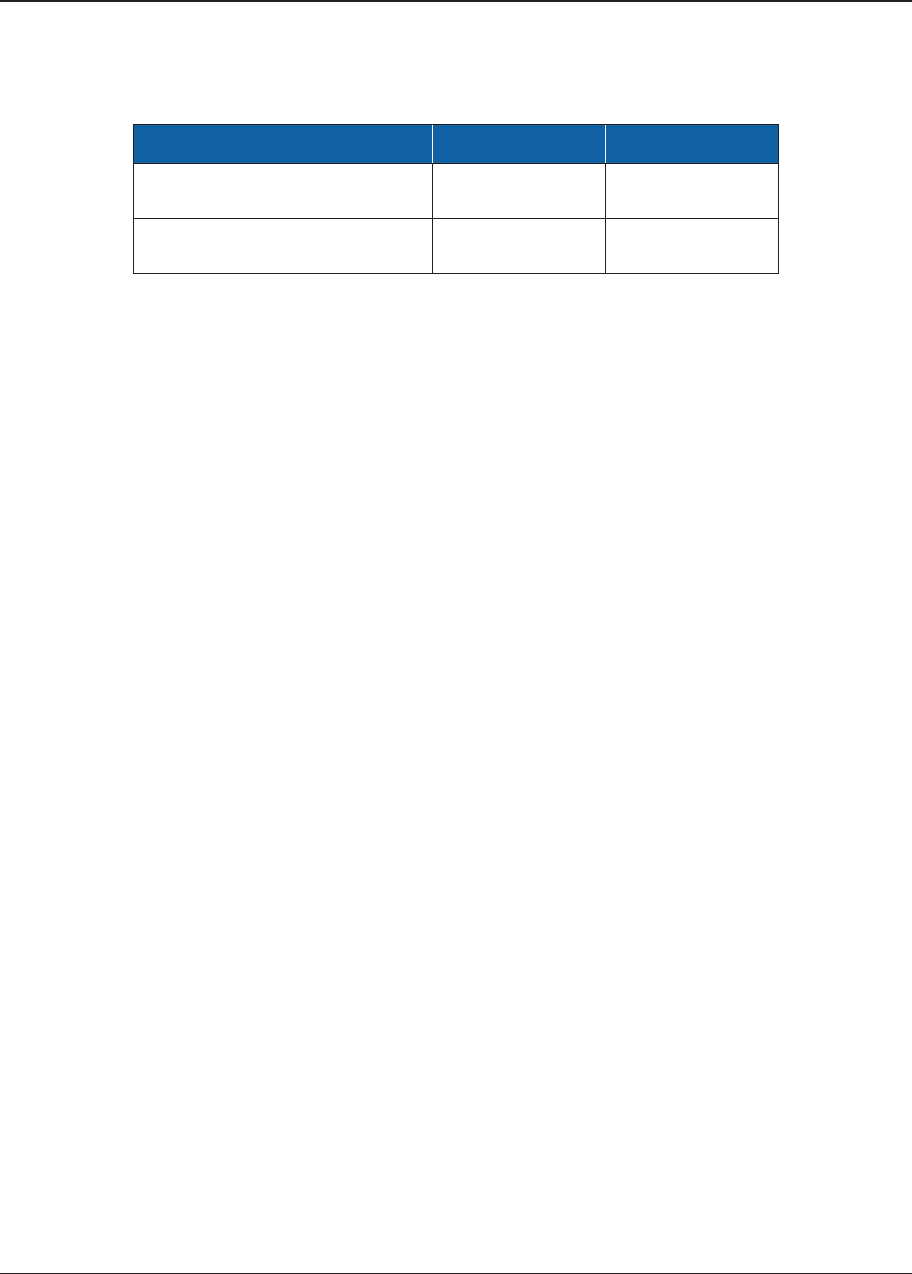

7.3 Summary of Nanny Tax gap estimates

Household employers are required to le Schedule H annually with their individual income tax returns to

report and remit the Federal payroll taxes for their employees. As indicated in Table , however, we estimate

that only . percent of household employers comply with this requirement.

TABLE 9. Estimated Schedule H ling compliance rate,

Tax Year 2015

Measure

Thousands of Schedule H

Returns

Actual returns led 191

Required returns 3,619

Filing rate 5.3%

Table 10 summarizes our estimates from Subsections 7.1 and 7.2 of the Federal Nanny Tax gap for Tax

Year 2015. We estimate that household employers failed to report and remit between $2.4 and $4 billion in

Federal payroll taxes for that year. When household employers pay their workers under the table, the employ-

ees are unlikely to report those earnings on their income tax returns. We estimate that this resulted in between

$979 million and $1.7 billion in unpaid Federal individual income taxes for Tax Year 2015. Overall, then, the

combined estimated Federal payroll and individual income tax gap associated with household employment

ranges from $3.35 billion and $5.7 billion in that year, which implies that only 22 percent to 32.4 percent of

all required taxes were reported and paid. As discussed below in Section 8, evidence we have derived from the

Consumer Expenditure Survey suggests that the upper bound of this range is quite plausible.

19

e average tax rate on domestic earnings was close to 10 percent prior to the application of refundable credits.

20

Note that we ignore potential income taxes on the wages of domestic workers whose earnings fell below the $1,900 annual Nanny Tax threshold.

Erard

TABLE 10. Estimated Federal Nanny Tax gap (in $ Millions),

Tax Year 2015

Tax Source Lower Bound Upper Bound

Payroll Taxes 2,370 4,029

Employee Income Taxes 979 1,666

Total Tax Gap 3,349 5,695

Compliance Rate 32.4% 22.0%

8. Evidence from the Consumer Expenditure Survey

To assess whether an individual was employed as a domestic worker, the CPS interviewer must collect infor-

mation relating to the identity of the employer (i.e., that the person works directly for a household and not,

say, for an incorporated business), the location where the work is performed (i.e., that the work is performed at

the employer’s own home), and the nature of the work. Individuals who are not authorized to work and those

who are being paid under the table may be reluctant to share such details during an interview. Indeed, the CPS

Interviewing Manual (U.S. Census ()) anticipates this problem. It states:

“Census employees in Jeersonville, Indiana assign industry codes based on the employer

name and the business or industry description you provide. ough some respondents are

reluctant to provide the name of their employer, this information is very helpful in assigning

the correct industry code. Without badgering the respondent, make every eort to collect

this information. In some cases it may only be necessary to reassure respondents of the

condentiality of the survey data.” (p. B–)

e interviewing manual also cautions:

“Some respondents may be reluctant to provide information about themselves or family

members or may refuse to be interviewed. It is your job to sell the survey.” (p. A–)

In practice, it seems unlikely that the interviewer will be successful in “selling the survey” in every instance

involving a reluctant respondent. As a result, it is reasonable to expect that some respondents will not disclose

sucient information to permit an inference that the individual was a domestic worker when this was, in fact,

the case. Likewise, some respondents are likely to understate their earnings from such employment or report

that they had no earnings.

As a check on our CPS-based estimates of the income earned by domestic workers, we have developed an

estimate of the amount spent by households on childcare assistance in their own home using the Consumer

Expenditure Survey (CEX). Although household employers may be reluctant to reveal childcare expenses

that they have paid under the table, it seems likely that they would be somewhat less averse to report such

transactions than their employees. Our CEX-based estimate is that households spent $9.4 billion for childcare

assistance in their own home in 2005.

21

Although a portion of this amount represents payments to relatives or

au pairs for babysitting, which are generally not subject to Nanny Tax, or domestic employee wages that fell

short of the $1,900 Schedule H ling threshold, most of it is attributable to annual payments to nonexempt

domestic employees who earned more than $1,900. Based on the estimated count of 549,214 private household

childcare workers from Section 5, this implies average annual earnings of $17,115, which is within 4 percent

of the average annual earnings reported in the CPS-ASEC among individuals who have indicated that their

longest-held job was as a domestic childcare provider ($17,822). is nding suggests the upper ends of the

estimated ranges of the household employer tax gap ($4 billion) and the domestic worker individual income

tax gap ($1.7 billion) are quite plausible.

21

Estimated expenditures on childcare, both inside and outside of the home, amounted to $14.9 billion in 2015. e CEX last broke down separate estimates for

childcare expenditures inside and outside of the home in 2012. In that year, babysitting, nanny services, or childcare inside the home accounted for almost 64

percent of the combined expenditures inside and outside of the home. Applying this percentage to combined estimated childcare expenditures of $14.9 billion in

2015 yields $9.4 billion in estimated expenditures on care inside the home.

Who Is Minding the Nanny Tax?

9. Demographic characteristics of domestic workers

Table presents summary statistics on the demographic characteristics of private household workers in

based on the weighted monthly CPS surveys. Strikingly, almost percent are female and approximately

percent are foreign born. According to estimates from Pew Research Center (Passel and Cohn ()), almost

half of all foreign-born domestic workers are unauthorized immigrants.

TABLE 11. Demographic characteristics, private

household workers over age 17, Tax Year 2015

Gender Percent Female 92.6

Race

Percent White Only 82.0

Percent Black Only 9.3

Nativity Percent Foreign Born 45.7

Age Mean Age 42

10. Closing the Nanny Tax gap

Most people devote substantial time and eort to hiring the right person to come into their home and look af-

ter their children, care for an aging parent, or clean their house. ey prepare job descriptions, search for leads

on potential job candidates, solicit and review applications, conduct interviews, check references, and carry

out background checks—all in an eort to determine whether a prospective employee is likely to be capable,

trustworthy, and responsible. Yet relatively few put similar eort into researching their own responsibilities as

household employers.

e extremely poor state of compliance with the Nanny Tax should be of concern to tax administrators,

policymakers, and other stakeholders—not only because it is a fairly substantial source of revenue leakage, but

also because it represents a signicant hole in the safety net for a relatively poor and vulnerable group of work-

ers. In this section, we discuss measures that the IRS should undertake to encourage household employers to

begin minding the Nanny Tax and their employees to comply with their income tax obligations.

10.1 e knowledge gap

One barrier to compliance is that many household employers are blissfully ignorant of their Nanny Tax re-

sponsibilities. Consequently, they oen misunderstand the rules regarding whether a worker is an employee

or an independent contractor, as well as the regulations concerning the employment of unauthorized immi-

grants. ese immigrants, themselves, oen misperceive that ling and paying income taxes on their earn-

ings will result in an immigration enforcement response. Each of these misperceptions contributes to the tax

compliance problem.

Misconceptions regarding employment status

Frequently, employers mistakenly assume that their domestic workers are self-employed independent con-

tractors and that they therefore have no responsibility to le information returns or collect and remit payroll

taxes on their behalf. Many domestic employees also incorrectly assume that they are self-employed, although

they may not fully understand or fulll the tax requirements that accompany self-employment status. In fact,

over percent of the workers who have been classied as private household employees in the American

Community Survey have identied themselves as self-employed.

Much of this confusion is attributable to the lack of clear and well-publicized guidelines. Although por-

tions of the available IRS publications on household employment are suciently clear to dispel some common

misconceptions regarding employer and employee rights and responsibilities, other portions are so vaguely

written that even a highly compliance-oriented individual might come to the wrong conclusion about whether

a household worker is really an employee. Consider, for example, the guidance provided in the IRS bulletin for

Tax Topic Number 756 (Employment Taxes for Household Employees) that is provided on its Website (Internal

Erard

Revenue Service (2018b)). e rst portion of this document addresses the distinction between a household

employee and an independent contractor:

“Household employees include housekeepers, maids, babysitters, gardeners, and others who

work in or around your private residence as your employee. Repairmen, plumbers, contractors,

and other business people who provide their services as independent contractors, are not your

employees. Household workers are your employees if you can control not only the work they do

but also how they do it (emphasis added).”

One might (correctly) reason from this brief description that, since domestic workers who are hired by a

homeowner are generally subject to the homeowner’s supervision and guidance, they should in most cases be

classied as employees. However, some household employers who give their domestic workers relatively free

reign in performing their duties might be led to conclude from this brief description that their workers are

not employees, but are instead self-employed independent contractors. Surprisingly, this is the full extent of

the guidance that is provided in this tax topic bulletin on this vital and commonly misunderstood issue. Even

more remarkably, the reader is not even referred to another information source for further details on how to

eectively apply this principle to conclusively determine whether a household worker is truly an employee.

A somewhat more detailed, but still inadequate, treatment of this issue is provided in IRS Publication 926

(Household Employer’s Tax Guide; IRS (2018a)). To the IRS’s credit, this publication does address several com-

mon misconceptions regarding the employment status of domestic workers. For instance, it claries that the

Nanny Tax applies to part-time as well as full-time employees, and it remains applicable regardless of the terms

of payment (hourly, daily, weekly, or by the job). When employers hire their caregivers through an agency, they

sometimes incorrectly assume that the agency will serve as the employer. While some home care agencies do

oversee caregivers and act as their direct employers, the services of many placement agencies and registries

are limited to referrals and other nonsupervisory tasks (such as background screening). In such cases, the

household serves as the direct employer of the caregiver, not the placement agency or registry. Publication 926

properly cautions that one may have a Nanny Tax responsibility even if the domestic worker was hired through

an agency or a list provided by an agency or association.

Unfortunately, Publication 926 is much less denitive when it comes to explaining how one can distin-

guish a household employee from an independent contractor. While it does provide some clarity with respect

to a couple of common household employment situations, it fails to resolve ambiguity and confusion in many

others. As with the Employment Taxes for Household Employees bulletin, Publication 926 emphasizes the com-

mon law principle that a domestic worker is one’s employee if “you can control not only what work is done,

but how it is done” (p. 3). However, this publication goes a bit further by also illustrating the application of this

principle to a couple of hypothetical scenarios. One scenario concerns a household worker who performs both

babysitting and light housework services. In this scenario, the worker is provided with specic instructions

on how to perform her duties as well as equipment and supplies to do the work. is combined provision of

specic instructions, equipment, and supplies by the employer is presented as evidence of control over both

what work is to be performed and how it is to be performed. e worker in this scenario is therefore identi-

ed as a household employee. While this example is adequate to clarify the employment status of many typical

caregivers that are hired by households, it does not resolve the uncertainty regarding employment status in

many other cases. For instance, one might wonder from this example whether the provision of both specic

instructions and supplies by the homeowner are required to establish an employer-employee relationship, or

if instead the provision of either one would suce. For instance, if a housekeeper brings her own equipment

and supplies but follows specic cleaning instructions provided by the homeowner, would she be considered

an employee or an independent contractor? How about a babysitter who is largely unsupervised but who relies

on items supplied by the homeowner (food, toys, games, etc.) in the process of caring for the child?

As an illustration of a household worker who is not an employee, Publication 926 introduces a second

scenario involving an individual who operates a lawn care business and oers his services to the general public.

22

e remainder of this IRS tax topic bulletin covers the ling and remittance responsibilities of household employers, which presumably will be read only if the

employer has concluded that its domestic worker is an employee. In these sections, the reader is referred to Publication 926 and certain other IRS publications for

additional details on these requirements. However, it is a rather remarkable oversight that a similar reference to a more detailed information source is not provided

in the portion of the bulletin that concerns the vital issue of employment status.

Who Is Minding the Nanny Tax?

is individual provides his own tools and supplies, and he hires helpers to assist with the work. In this case

we learn that neither this individual nor his helpers are household employees. Although this example claries

employment status under a fairly typical lawn service situation, it does little to remove uncertainty regarding

other common situations. For instance, suppose that the lawn care provider did not hire additional helpers,

would he still be an independent contractor? How about if he provided his own gas and oil but used the home-

owner’s lawnmower or blower? One cannot be sure based on the information that has been provided.

ose who remain confused about what constitutes an employer-employee relationship aer reading Pub-

lication 926 are referred to sections 1 and 2 of IRS Publication 15-A (Supplemental Employer’s Tax Guide, IRS,

2017a). In Section 1 of this guide, we learn that it does not matter whether you control how the work is done,

so long as you have a right to do so:

“An individual is generally your employee if you have the right to control what will be done

and how it will be done. is is so even when you give the employee freedom of action. What

matters is that you have the right to control the details of how the services are performed.”

(p. )

is is an important distinction, because it means that a domestic worker is deemed to be an employee so

long as one has the authority to give explicit instructions, regardless of whether any explicit instructions are

provided. e failure to explain this distinction in the previously discussed tax publications could lead some

household employers to assume wrongly that their domestic helpers are independent contractors. Consider,

for instance, the aforementioned example of household employers who elect to give their domestic workers

relatively free reign in carrying out their duties.

Section 2 of this supplemental guide describes various factors that should be considered when assessing

the degree to which a worker is subject to behavioral control (such as whether the worker is told what tools to

use or what hours to work) or nancial control (such as whether the worker has made a signicant investment

in tools and equipment or has an opportunity to realize a prot). In addition, there is a discussion of relevant

indicators of the type of relationship between the parties, such as the presence of a contract that species the

terms of the relationship, the presence of employee-type benets (such as sick pay or vacation pay), or whether

the engagement is for a specied period or indenite. To illustrate how to apply these factors to assess whether

a worker is an employee, a number of examples are provided. Notably, however, not one of them concerns the

case of a domestic worker. Moreover, the limited discussion of the presence of a contract as a relevant factor

in assessing employment status might feed into the commonly held misconception that a household employer

can legally dodge the Nanny Tax simply by executing a contract that designates the employee as an indepen-

dent contractor. erefore, even this more detailed publication falls short of providing household employers

with clear and adequate guidance regarding what constitutes an employer-employee relationship.

From the perspective of the IRS, it seems as though the employment status of domestic workers actually

has been a largely settled issue for quite some time. For instance, during the Congressional hearings that led to

the introduction of Schedule H (Committee on Ways and Means (1993)), Maurice Washburn, the Compliance

2000 Executive of the IRS at that time, testied that domestic workers are almost always employees of the per-

son in whose home they perform services, because that person “almost invariably” has the right to direct and

control the performance of those services (p. 38). e one exception he notes is when a business organization,

such as a commercial housecleaning company, has the right to direct and control how the services are carried

out, in which case the housecleaning company is the employer, not the homeowner. Observe that the domestic

worker is classied as an employee under both of these scenarios, not as an independent contractor. Assuming

that this continues to be the position of the IRS today, it is puzzling that this position is not plainly stated in the

IRS publications on this topic. e failure of the IRS to stake out a clear position on the employment status of

household workers in its publications invites confusion and contributes to the ongoing compliance problems.

e IRS does oer one way to obtain clarity on a domestic worker’s employment status. Either the house-

hold employer or the worker can le IRS Form SS-8 (Determination of Worker Status for Purposes of Federal

Employment Taxes and Income Tax Withholding) to request a determination of the worker’s employment sta-

tus. Unfortunately, however, this form was designed rather generically in the context of a rm that hires a

worker, which makes it rather confusing for households and domestic workers to complete. In addition, a ler

can expect it to take at least 6 months before a determination is provided by the IRS (Internal Revenue Service

Erard

(2017b)). Still, this is a valuable service from which many household employers and domestic workers could

benet. However, the IRS does not publicize its availability in the Employment Taxes for Household Employees

bulletin or even in Publication 926, which are the two main publications that focus on household employ-

ment. (ere is, at least, a brief mention of the service on page 8 of the Supplemental Employer’s Tax Guide.) Of

course, many household employers and employees would not have any need for this service in the rst place if

these publications were revised to provide clearer guidance on this issue.

Perhaps tellingly, Stephanie Breedlove (2013, p. 19) reports that her payroll tax service company, Care.com

HomePay, has petitioned the IRS for employment status determinations under a wide range of domestic work

scenarios using Form SS-8. She indicates that in every case, the IRS has deemed the worker to be an employee

of the household.

Misunderstanding of regulations concerning unauthorized immigrants

Beyond the misconceptions regarding the employment status of household workers, there is also substantial

confusion surrounding the employment of unauthorized immigrants. Unauthorized immigrants are estimated

to represent only about percent of the overall U.S. workforce, but they account for approximately percent

of all private household workers (Passel and Cohn ()), which means that the household workplace is an

area where all the various labor market and social issues surrounding the topic of illegal immigration come

to a head. Many household employers rely on a “don’t ask, don’t tell” policy when hiring unauthorized immi-

grants, hoping that ignorance of their work authorization status will shield them from any legal repercussions.

In fact, though, household employers are legally obliged to verify a prospective employee’s eligibility to work

and to complete USCIS Form I- (Employer Eligibility Verication) prior to making a hire.

As for household

employers who do knowingly hire unauthorized domestic workers, there is oen a misconception that the lack

of legal work authorization exempts them from payroll tax requirements.

Many unauthorized immigrants fear that the payment of income and payroll taxes will trigger an im-

migration enforcement response. In fact, though, the IRS maintains the condentiality of taxpayer records

and issues Individual Taxpayer Identication Numbers (ITINs) to undocumented workers upon request to

facilitate the ling and payment of taxes. Although unauthorized immigrants are not eligible for many social

and tax-related benets, such as Medicare, Social Security, or the Earned Income Credit, tax records provide

documentation of their earnings history, which is needed when attempting to rent an apartment, purchase a

car, qualify for a mortgage, or secure a personal loan. In addition, if a previously unauthorized worker later

receives work authorization and is issued a Social Security Number, that worker can receive credit for the past

Social Security contributions that were made during the period of unauthorized employment. Furthermore,

should an unauthorized immigrant nd herself before an immigration judge, a history of ling and paying

taxes may improve the chances of a favorable adjudication (Blanco (2017)).

10.2 Addressing the knowledge gap

Clearly, then, the Nanny Tax gap is partly attributable to a knowledge gap. e IRS can help to close this knowl-

edge gap by devoting more resources towards educating household employers and their employees about their

rights and responsibilities. Much as the IRS has done for other tax issues associated with substantial compli-

ance problems, such as the Earned Income Credit, it should engage in:

• Targeted information campaigns;

• Community outreach eorts; and

• Partnerships with other stakeholders, including tax preparers, State revenue administrations, and

household employee advocacy groups.

ese educational eorts should address confusion regarding independent contractor status, the importance

of Social Security, Medicare, and unemployment benets to domestic workers, employer payroll tax and

23

ese requirements are clearly explained in Publication 926 IRS (2018b, p. 3); however, employers of potentially unauthorized immigrants may not be inclined to

seek out published guidance on this issue.

Who Is Minding the Nanny Tax?

information reporting responsibilities, employee income tax reporting obligations, and the risks and penalties

associated with noncompliance.

IRS publications on household employment should also be revised to state more plainly the Agency’s po-

sition on the circumstances under which domestic workers are deemed to be household employees. Beyond

improving these publications, the IRS should introduce an online application similar to the “employee/con-

tractor decision tool” that the Australian Taxation Oce makes available to its taxpayers (see https://www.ato.

gov.au/calculators-and-tools/employee-or-contractor/). is easy-to-use application takes the user through a

series of questions that lead to a clear determination of whether a worker is an employee or an independent

contractor. Provided that the user has given accurate responses to the questions, the user can then rely on this

determination for tax purposes. A record of the responses and the resulting determination can be downloaded

by the user to demonstrate due-diligence in the event of an audit. Such an application would be relatively in-

expensive for the IRS to develop and maintain, and it would serve as a fast, easy, and immensely helpful means

for household employers and domestic workers to resolve their uncertainty over the employee-independent

contractor issue.

As discussed previously in Subsection 10.1, the IRS position on household workers that was shared during

the 1993 Congressional hearings on the Nanny Tax was that these workers are almost always employees of the

person in whose home they perform services. Assuming this remains the IRS position today, it should explore

working with lawmakers to establish a rebuttable presumption that an employer-employee relationship exists

when a household hires a worker to perform personal services in or around the home. e burden would then

be placed on the household to rebut this classication, for instance by providing evidence that the worker op-

erates or is employed by a business that has the right to control how the work is performed.

e proposed outreach eorts and information campaigns should highlight the legal requirement for

household employers to verify work authorization status and the potentially severe consequences for noncom-

pliance. To the extent that household employers continue to employ unauthorized immigrants, it is important

to reassure undocumented workers that ling an income tax return will not result in an immigration enforce-

ment response and to inform them of the various benets of establishing a tax ling history and paying their

share of taxes (building consumer credit, demonstration of law-abiding behavior to reduce the potential for

deportation, etc.). e IRS should team with other stakeholders to develop and implement eective strategies

for outreach and information dissemination.

10.3 Reducing compliance burdens and increasing enforcement

Of course, the Nanny Tax gap is not entirely attributable to a knowledge gap. Many household employers are

aware of their payroll tax responsibilities but choose not to comply, either because they feel that Federal and

State ling and remittance requirements are too burdensome or because they simply do not want to bear the

added expense associated with Federal and State payroll taxes. e introduction of Schedule H in did

simplify compliance with Federal Nanny Tax requirements to some degree. However, it did nothing to address

the State-level Nanny Tax compliance burden. It would certainly be desirable for the Federal and State tax

administrations to explore ways to coordinate and simplify the overall compliance process. Although the best

way to achieve that outcome will require investigation and deliberation, one approach to simplication would

involve the introduction of uniform ling and remittance frequencies across jurisdictions. e payroll tax re-

porting process for employers of undocumented workers is another area that might be addressed. Some States

will not accept wage reports and payroll tax lings that don’t list an employee’s SSN. Because undocumented

workers are unable to obtain an SSN, their employers are eectively impeded from complying with their State

payroll tax obligations. A uniform process across all jurisdictions for identifying undocumented workers for

payroll tax and wage reporting purposes, such as the reliance on an ITIN, would make it easier for those who

violate hiring laws to at least avoid also becoming tax evaders.

Outreach, education, and burden reduction are important elements of a strategy for reducing the Nanny

Tax gap. Ultimately, however, enhanced enforcement of payroll tax return ling and remittance requirements

is also needed to transform the culture of Nanny Tax noncompliance into one of compliance. Presently, even

rather thorough tax audits, such as those conducted under the IRS National Research Program (NRP), fail to

Erard

uncover most instances of Nanny Tax evasion. Under the NRP, a large stratied random sample of Federal

individual income taxpayers is audited for a given tax year. One of the purposes of this program is to measure

the magnitude of tax noncompliance in the overall population with respect to the various income, deduction,

and credit items on the tax return. Haskins (2010) reports that NRP audits conducted on Tax Year 2001 returns

succeeded in identifying only a handful of household employers who had failed to le Schedule H. In fact, if

one were to rely on the evidence from these audits, one would mistakenly infer that more than 98 percent of

all required Nanny Taxes were duly reported in that year.

Clearly, even these rather thorough audits that are specically designed to measure noncompliance are not

up to the task when it comes to Nanny Tax evasion. e IRS needs to develop more eective methods to probe

for the presence of domestic workers and to apply these methods more routinely, especially when examining

returns that t the prole for Nanny Tax noncompliance; for instance, returns of dual-earner households that

report dependent children but do not claim the Child and Dependent Care Credit. In short, what is needed

is a well-designed “compliance campaign” along the lines of the tailored compliance campaigns that the IRS

has begun rolling out to address specic large and international business compliance issues (Internal Revenue

Service (2017c)). An important objective of this campaign should be to make the perceived risk of detection

and punishment more salient among Nanny Tax evaders. Until household employers perceive that Nanny Tax

evasion will not be tolerated by the IRS, the current culture of noncompliance will persist.

Assuming the IRS is successful in substantially improving compliance among household employers, this

should help to promote greater compliance among their domestic employees as well. Once a W-2 form has

been issued and payroll taxes have been reported, domestic employees have a strong incentive to le an income

tax return and properly report their earnings. On the other hand, it is not always the employer who drives the

compliance decision; household workers sometimes insist on being paid under the table. erefore, an eec-

tive compliance campaign must focus on promoting buy-in among domestic workers as well as household

employers.

Sometimes amnesties are introduced prior to the execution of a new compliance program to provide non-

compliant taxpayers with an opportunity to “get right” with the tax administration before they nd themselves

subject to sti penalties and nes under the new regime. e IRS should consider oering an amnesty prior to

the launch of a Nanny Tax compliance campaign as a potential way to encourage Nanny Tax evaders to come

forward voluntarily and to ease the transition process.

Normally, employers are required to withhold income taxes from employee earnings. is measure was

introduced during World War II to promote the ecient collection of revenue following the massive expan-

sion of income taxation to fund the war eort (Higgs (2007)). Since that time, it has proven to be a very eec-

tive way to ensure tax compliance. e IRS estimates that 99 percent of all wages are properly reported by lers

of individual income tax returns (Internal Revenue Service (2016)). Under the current Nanny Tax regulations,

however, household employers are not required to withhold income taxes from their employees’ pay. When

taxes on one’s earnings are not withheld, compliance-minded taxpayers face the prospect of having to make

regular estimated tax payments on their own or else risk experiencing hey tax obligations (and, potentially

late-payment penalties) that they may not be equipped to pay when they le their tax returns in the following

year. Lawmakers should consider making the withholding of income taxes mandatory for household employ-

ers, just as it is for other employers. Although this would increase the compliance burden for household em-

ployers to some degree, it would reduce the compliance burden for their employees and promote compliance

with their income tax obligations.

11. Conclusion

e vast majority of household employers are not minding the Nanny Tax. As a result, signicant tax revenue

is going uncollected, and many domestic workers are le without an adequate safety net when they become

unemployed, sick, elderly, or disabled. To transform the existing culture of Nanny Tax noncompliance, it is

necessary to implement a comprehensive strategy that addresses the root causes of the problem, which include

informational barriers, inadequate enforcement, and high Federal-State compliance burdens. is study has

proposed measures to address each of these issues.

Who Is Minding the Nanny Tax?

References

Blanco, O. (2017, April 19). Why undocumented immigrants pay taxes. CNN Money. Retrieved from http://

money.cnn.com/2017/04/19/news/economy/undocumented-immigrant-taxes/index.html.

Bloomquist, K.M., and Z. An. (2006). Geographic variation in Schedule H ling rates: Why should location

inuence the decision to report “Nanny Taxes”? In Proceedings of the National Tax Association 98th Annual

Conference. Washington, DC, Nov. 17–19, 2005. Retrieved from https://www.irs.gov/pub/irs-soi/05bloom.

pdf.

Breedlove, S. (2013). How to avoid the top 4 household employment tax mistakes. CPA Practice Advisor 23(10),

18–19. Retrieved from https://cpapracticeadvisor.epubxp.com/i/183150-oct-2013/0?m4.

Committee on Ways and Means, House of Representatives, Proposals to simplify and streamline the payment

of employment taxes for domestic workers. Hearing before the Subcommittee on Social Security and the